The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every Saturday in your inbox.

Welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

It was a busy week in the world of transportation, particularly around automated vehicle technology. Let’s get to it.

Email me anytime at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

New York is one of the last big scooter markets yet to be decided. The city released October 30 a “Request for Expressions of Interest” for its pilot scooter program as well as a separate request for companies that provide ancillary services to the electric scooter industry, such as data aggregation and analysis, on-street charging and parking vendors, safe-riding training courses as well as scooter collection and impound services.

This officially kicks off the process to determine what companies will receive permits to operate in the city. It promises to be a competitive battle for one of the most coveted markets in the world. In the hours after the city released its RFEIs, I received a number of emails with statements from scooter companies, each one touting its experience, focus on safety and business strategy.

Some important decisions from the city have yet to be determined, or at least shared with the public such as exactly where the scooters will be allowed and what requirements will be placed on the companies that want to operate there. We know Manhattan is out as scooters are not allowed. That leaves four other boroughs, including Brooklyn, the Bronx, Queens and Staten Island.

Meanwhile, in the ebike world …

Harley-Davidson announced that it has spun out a new business dedicated to electric bicycles and plans to bring its first line of products to market in spring 2021.

The pedal assist electric bicycle company is being launched amid a booming e-bike industry fueled by growing demand in the wake of the COVID-19 pandemic. The global e-bicycle market was estimated to be over $15 billion in 2019 and projected to grow at an annual rate of more than 6% from 2020 to 2025. The demand is there; might this be how Harley-Davidson connects with the next-generation of customers?

The new business, called Serial 1 Cycle Company, started as a project within the motorcycle manufacturer’s product development center. The name comes from “Serial Number One,” the nickname for Harley-Davidson’s oldest-known motorcycle.

Deal of the week

Fisker Inc. became the latest in a group of speculative electric vehicle startups to go public via a merger with a special purpose acquisition company. Fisker had announced back in July — and right after raising $50 milion from investors — that it had reached an agreement to merge with Spartan Energy Acquisition Corp., a special purpose acquisition company sponsored by an affiliate of Apollo Global Management Inc.

The merger closed this week and Fisker made its debut on the New York Stock Exchange. Its first day of trading was Friday and pop went the shares, closing up 13%. It’s important to note that Fisker isn’t generating any revenue and doesn’t have a vehicle in production yet, although it did recently lock in a manufacturing agreement with Magna to build its first vehicle, the Ocean SUV. Fisker has said it will begin to deliver the Ocean SUV in 2022.

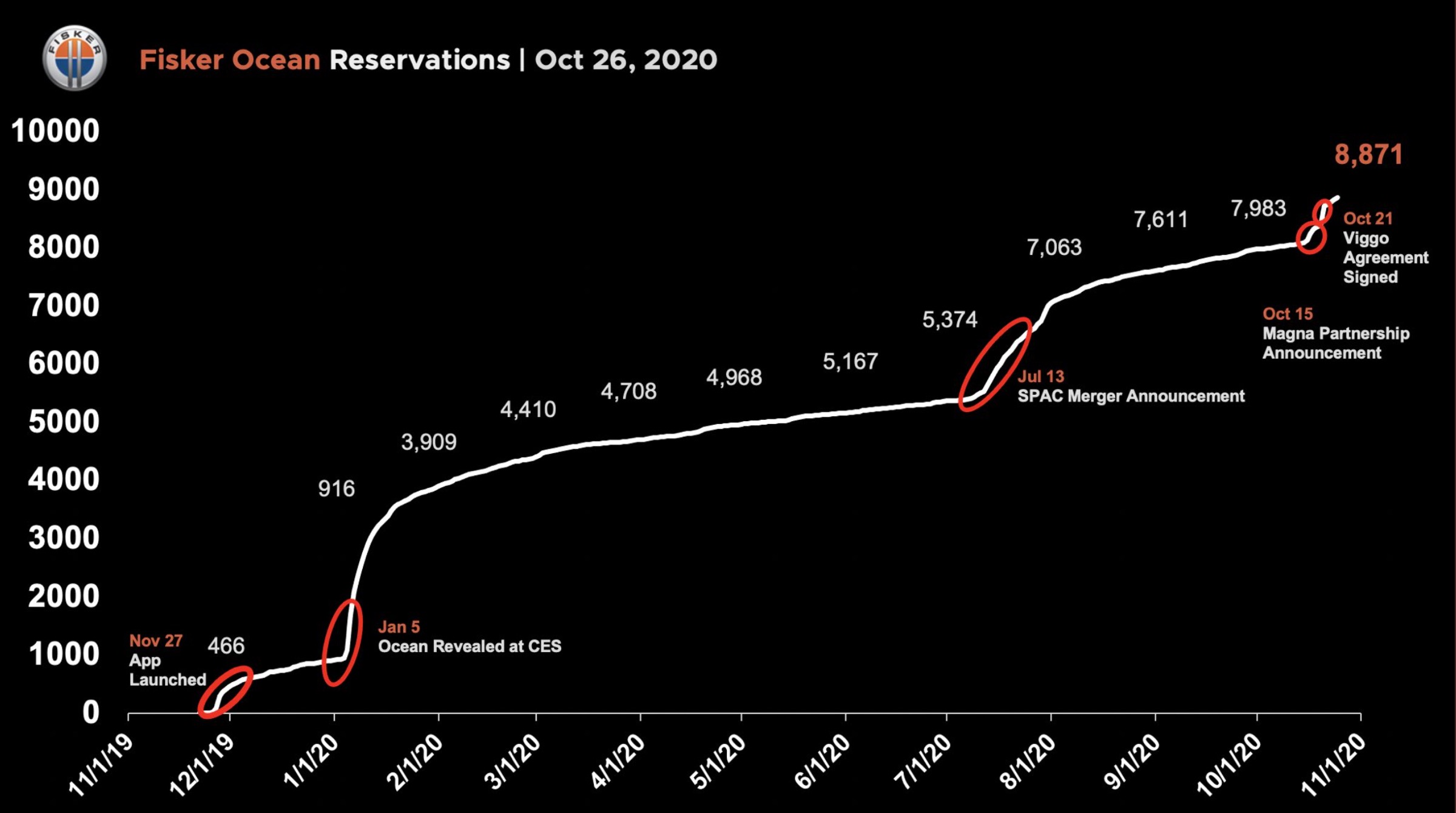

Henrik Fisker, the famous car designer and founder of the company, tweeted this week figures on reservations of the Ocean, which he pegged at 8,871. My big questions are how many vehicles does Fisker need to make and sell to break even, or dare I say, turn a profit? Is 9,000 vehicles enough? And will these reservations convert into actual sales? (a screenshot below of Fisker’s reservation figures)

Other deals that caught our attention …

Continental took a minority stake into lidar develop Aeye. The companies didn’t disclose what “minority stake” means. However, the folks at Aeye were able to say that its the company’s largest Tier 1 investor to-date, and it’s a multi-faceted partnership that brings together a joint team of about 300 lidar engineers to develop and industrialize the long-range lidar product. The investment follows news that Aeye has appointed its president Blair LaCorte to the CEO position. Jon Lauckner, formerly CTO at GM, Dr. Bernd Gottschalk, an automotive executive and consultant who served on Daimler AG’s board and is the founder and managing partner of automotive consultancy AutoValue,

Frank Petznick, the executive vice president of advanced driver assistance systems at Continental and Keith Dierkx, a longtime IBM executive, also joined Aeye’s advisory board last month.

Hermeus, a startup aiming to build a Mach 5 aircraft capable of making the trip from New York to London in just 90 minutes, raised $16 million in a Series A round led by Canaan Partners. Existing investors Khosla Ventures, Bling Capital and the Rise of the Rest Seed Fund also participated in the round.

Outrider, a startup that developed a system of autonomous yard trucks, has raised $65 million in funding just eight months after coming out of stealth. The Series B round was led by Koch Disruptive Technologies and brings its total funding raised to $118 million. Other existing investors increased their investments, including NEA, 8VC and Prologis Ventures. New investors included Henry Crown and Company and Evolv Ventures.

Root Inc., the Ohio-based auto insurance platform, raised $724 million through its U.S. initial public offering. The company sold 24.2 million shares at $27 each — above the marketed range of $22 to $25 a share. The company also raised $500 million through sales of common shares to Dragoneer Investment Group and Silver Lake, according to an SEC filing.

Ryder System, the shipping, logistics, and truck rental company, launched a $50 million venture fund. TechCrunch’s Jonathan Shieber digs into why.

WiTricity closed a $34 million investment round led by Stage 1 Ventures with participation from Air Waves Wireless Electricity and a strategic investment by Mitsubishi Corporation through its U.S. subsidiary, Mitsubishi Corporation (Americas). WiTricity said the funds will be used to continue wireless power platform development, expand its intellectual property portfolio, and capitalize on the commercial momentum for wireless charging for electric vehicles.

A little bird

Typically, my “little bird” section is dedicated to vetted and multi-sourced tidbits that have yet to be reported out. This week is a bit different. I’m going to tap into my experience of reporting on and observing the AV industry, throw in a little reading of the Twitter tea leaves and make a prediction of what I believe is going to be one of the more interesting partnerships.

My big prediction in 2020 is. …. automated vehicle technology startup Voyage and electric vehicle startup and newly public company Canoo will partner on a vehicle. There I said it. Done. How could I dare be so bold? Let’s just say I’ve seen lots of love between Voyage and Canoo; to me it seems like more than just admiration. ;D

In actual publicly announced news, Voyage said it is teaming up with First Transit to deploy and operate robotaxis in communities like The Villages. Voyage has been testing and giving rides (with a human safety driver behind the wheel) in the senior community the Villages for some time now. Meanwhile, First Transit has six decades of experience as a transportation company.

Oliver Cameron, founder and CEO of Voyage, explained why the company partnered with First Transit in a recent tweet (there’s also a blog post). He wrote, “Robotaxis are a new business in many ways, but many of the challenges within have already been solved by tried-and-tested players (like @FirstTransit). So, why not partner instead of reinventing the wheel?”

Expect more partnerships between the companies developing the technology and those that have experience in transportation operations. We saw another example of these kind of AV-operator partnerships this week. Motional, the Hyundai-Aptiv joint venture, and on-demand shuttle startup Via announced plans to launch a shared robotaxi service for the public in a U.S. city in the first half of 2021. The companies said the aim is to develop a “blueprint” for on-demand shared robotaxis and learn how these driverless vehicles can be integrated into mass transit.

Waymo makes its safety case

While I was on vacation, Waymo dropped a massive amount of data on its autonomous vehicle operations in Phoenix, Arizona. This data dump offers insight into more than just the number of crashes — 18 — or near misses — 29 — over the past 20 months. It provides the first real detailed look at Waymo’s automated system and operations.

The company published two papers detailing its safety methodologies and readiness as well as public road safety performance data, which analyzes the miles Waymo has driven on public roads in Arizona. The first paper digs into its three layered approach to safety, which includes the hardware, the automated driving system behavior and operations.

I’m still reading through the papers and will add more thoughts on this soon, but in the meantime here are my two big takeaways.

- Waymo is finally providing a detailed answer to questions I have asked the company, including its CTO Dmitri Dolgov, which is “how safe is safe enough?” and “how do you know when it is safe enough?”

- Automated vehicle technology companies are starting to compete on transparency.

Notable reads and other tidbits

Here are a few other items were noting.

Daimler Trucks and Waymo announced a partnership to build an autonomous version of the Freightliner Cascadia truck. This is Waymo’s first deal in the freight business. Then a few days later, Daimler Trucks announced it had invested in lidar developer Luminar as part of a broader partnership to produce autonomous trucks capable of navigating highways without a human driver behind the wheel.

These deals are the latest action by the German manufacturer to move away from robotaxis and shared mobility and instead focus on how automated vehicle technology can be applied to freight.

Grab and Marriott International announced a partnership that will cover the hospitality giant’s dining businesses in six Southeast Asian countries: Singapore, Indonesia, Malaysia, the Philippines, Vietnam and Thailand. Instead of room bookings, the Marriott International deal with Grab focuses on about 600 restaurants and bars at its properties in the six Southeast Asian countries, which will start being added to GrabFood’s on-demand delivery platform in November.

Postmates is now rolling out what could be the biggest update to the company’s service in a long time. The company is adding a retail option for users — starting in Los Angeles — to shop local stores and for local merchants to set up a virtual on-demand storefront in the app. Postmates users will be able to shop local merchants listed in the company’s new retail tab in the Postmates app called, appropriately, “Shop.”

Scott Painter, the founder of used-vehicle subscription service Fair, has been working quietly to raise money and launch a new software-as-a-service platform to help subscription providers achieve scale and become profitable, Automotive News reported. Painter stepped down as Fair’s CEO last year. His new company will be called NextCar.

Tesla raised the price of its FSD software (short for “full self-driving, and no it’s not self driving) to $10,000. The FSD package, which owners can opt for, has been steadily rising over the past year. The price increase comes just a few days after the company started to roll out a beta version of the software update. To be clear, FSD is not what the industry or even the federal agency NHTSA defines as Level 4 autonomy per standards defined by SAE International. Tesla vehicles with FSD require supervision at all times and a human driver must be ready to take over — and if you’ve seen any of the videos, welp yeah they need to take over. Level 4 under SAE standards require no driver intervention in certain conditions.

Uber said it has received more than 8,500 demands for arbitration as a result of it ditching delivery fees for some Black-owned restaurants via Uber Eats.

Uber is also facing another legal challenge in Europe related to algorithmic decision making. The App Drivers & Couriers Union (ADCU) has filed a case with a court in the Netherlands seeking to challenge the ride hailing company’s practice of ‘robo-firing’ — aka the use of automated systems to identify fraudulent activity and terminate drivers based on that analysis.

[ad_2]

Source link