News that UK-based used car seller Cazoo intends to list in the United States via a SPAC is not surprising. After all, the SPAC boom we’ve seen in recent quarters means that there are a host of American blank-check companies in the market looking for deals — why would they stop at domestic borders?

But the Cazoo deal is not a surprise for other reasons as well. We’ve seen the value of related American company Carvana spike in recent years after its 2017 IPO, for example. And Carvana has shown the sort of gross-margin improvement that Cazoo intends to manage in the coming years, so there’s precedent for its sales model to show economic improvements over time..

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But coming at the same time as a sunny investor deck detailing why the Cazoo-AJAX I deal is a good idea are a number of public-market trembles that could indicate uncertain risk tolerance among public investors. We can see this in the slack debut of several Chinese companies, as well as the downward pressure on the public offering for Deliveroo, a food-delivery platform.

Is the public market’s enthusiasm for tech listings slowing? If so, it would be bad news for companies that have announced SPAC-led debuts, firms like Latch that priced their combination during a particular market climate. One that won’t match well to a risk-off environment, if that’s where things head.

Is the public market’s enthusiasm for tech listings slowing? If so, it would be bad news for companies that have announced SPAC-led debuts, firms like Latch that priced their combination during a particular market climate. One that won’t match well to a risk-off environment, if that’s where things head.

This morning, let’s parse the Cazoo deck briefly and then ask ourselves what the market tea leaves are telling us about investor appetite for risky shares.

Cazoo

After reading the Cazoo and Deliveroo news this morning, I have to ask if there’s something particularly British about companies ending in -oo. Let me know.

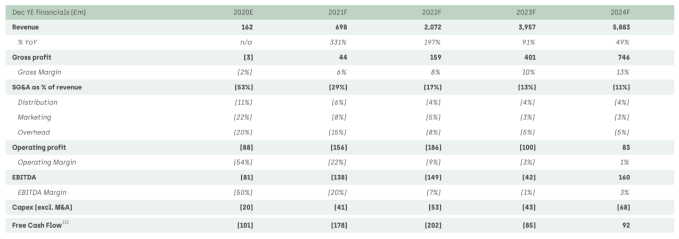

Regardless, the Cazoo investor deck for its SPAC deal is here. Follow along if you want. We’re starting on page 33, where the company discloses its 2020 results and forecasts the next several:

Via Cazoo’s investor deck.