Uber reported its second-quarter earnings Thursday and buried in the blizzard of less-than-rosy numbers is a stunning figure that illustrates how much the company has changed during the COVID-19 pandemic.

Uber’s delivery business — better known as Uber Eats — is now bigger than its original and core ride-hailing division, based on adjusted net revenue. Now, adjusted net revenue tells only a piece of this evolving Uber story. Income, or losses in the case of Uber’s delivery business, are also important.

Still, looking at the change of the past year, and specifically in the past two quarters, it’s clear that Uber’s strategy has shifted. And all eyes are on delivery.

Before digging deeper, let’s run a quick recap.

Uber’s reported net loss was $1.78 billion in the second quarter of 2020, down from a year-ago net loss of $5.24 billion. The company went public last year, resulting in various one-time, non-cash costs. The company’s net loss worked out to a loss of $1.02 per share. That was enough to beat analysts’ expectations of a $0.86 per-share deficit.

Uber missed on profitability in the quarter, but did surpass expectations on top line, posting more revenue than the $2.18 billion figure investors expected.

The shift to delivery

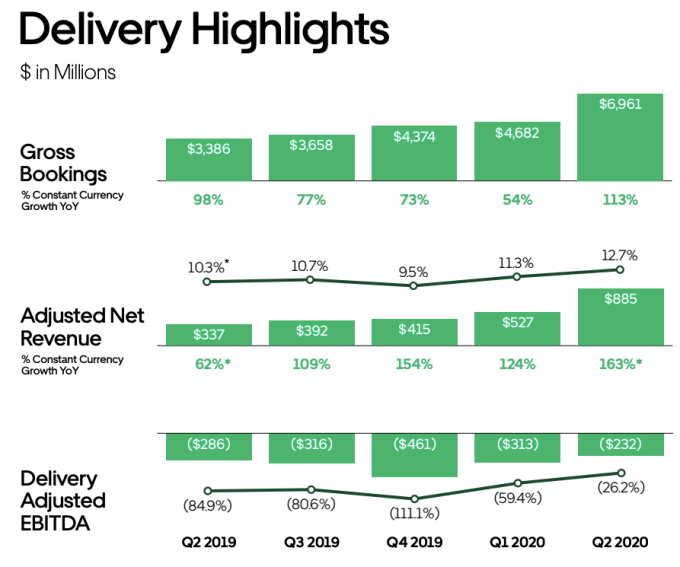

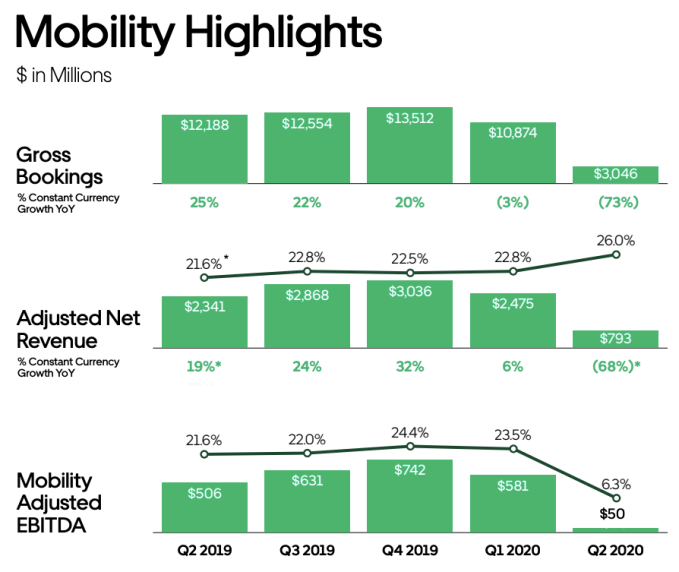

There are three key ways to weigh the company’s various businesses, of which only two are of material scale to the Uber’s operating results, namely Mobility (ride-hailing), and Delivery (Uber Eats) . Here’s how the pair stacked up in Q2 2020:

- Delivery gross bookings: $6.96 billion

- Mobility gross bookings: $3.05 billion

Here’s how those gross bookings results turned into adjusted net revenue:

- Delivery adjusted net revenue: $885 million

- Mobility adjusted net revenue: $793 million

And how those revenue results turned into adjusted profit, and adjusted losses:

- Delivery adjusted EBITDA: -$232 million

- Mobility adjusted EBITDA: $50 million

As you can see, Uber’s food delivery business is doing far more gross dollars in transaction volume. However, as Uber has a better take-rate (the portion of gross spend it gets to keep as revenue) with ride-hailing than Uber Eats, the two had far closer adjusted net revenue numbers. Here, again, Delivery beat Mobility.

When it came down to adjusted profit, Uber’s traditionally-core business of ride-hailing generated the superior result, generating positive adjusted EBITDA, while delivery lost money using the same profit calculation method.

In Q1 2020, Mobility generated more gross bookings, adjusted net revenue, and adjusted EBITDA than Delivery. In Q2, due to COVID-19 and its resulting economic impacts, two of the three numbers flipped. How fast the figures could change in the future if the market for ride-hailing recovers further, is not clear. Today’s earnings call made it clear that Uber is more about bringing you food than taking you to the airport, and that’s a big change for the American company.

To be clear, ride-hailing isn’t going anywhere. It’s the dual focus of delivery and ride-hailing that Uber is counting on to get it through this rough patch of COVID-19 pandemic as well as fortify its revenue earning potential in more stable times.

“It’s become clear that we have a hugely valuable hedge across our two core businesses that is a critical advantage in any recovery scenario,” Uber CEO Dara Khosrowshahi said Thursday. “When travel restrictions lift we know the mobility trips rebound. If restrictions continue or need to be re-imposed our delivery business will compensate.”

Graphical context

For fun, here are the pertinent sections of Uber’s Q2 investor slides.

Here’s the company’s Mobility numbers:

Image Credits: Uber

And, here are its Delivery results:

Happy number crunching!

[ad_2]

Source link