The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every Saturday in your inbox.

Hello and welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

A series of recent and upcoming vehicle reveals have provided yet another reminder of how automakers are doubling down on tech. This isn’t just about the shift away from knobs and buttons and towards giant touchscreens. I’m talking about advanced driver assistance systems and more specifically, ADA or active driving assistance. ADA is considered a part of ADAS, but it’s worth understanding what it is and is not. ADA systems combine steering, acceleration and braking. It’s technology that actively assists the driver.

Tesla’s Autopilot and GM’s Super Cruise, both of which combine adaptive cruise control and lane keeping assistance, are examples of ADA.

AAA automotive researchers recently conducted tests of these ADA systems. (A photo of a test vehicle colliding with a fake simulated vehicle is below) They found that over the course of 4,000 miles of real-world driving tests, vehicles equipped with active driving assistance systems experienced some type of issue every 8 miles, on average. Other problems included disengaging with little notice and “almost instantly” handing control back to the driver.

Based on the study, AAA is recommending automakers “increase the scope of testing for active driving assistance systems and limit their rollout until functionality is improved to provide a more consistent and safer driver experience.”

I’ll add my own two cents in here. It’s not just about ensuring the systems work as intended. It’s also important that these systems have protections, like driver monitoring systems, so that if control is suddenly handed back to the driver, you can be sure that they will be ready.

Friendly reminder that you can reach out and email me anytime at kirsten.korosec@techcrunch.com to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

There’s a hot trend brewing the micromobility world: hardware-as-a-service.

Unagi, the company that sells sleek, portable electric scooters, has launched a subscription service. The service, called Unagi All-Access, will be offered in New York City and Los Angeles. The company said it plans to expand to additional markets as it gathers customer feedback and refines the service.

For a flat monthly fee of $39 (or $34 if a customer signs up for a year), Unagi will cover maintenance and insurance for scooter theft or damage.

Unagi isn’t alone in this scooter subscription pivot, or what I like to call hardware-as-a-service. Others are also pursuing this business model, including Dance and Voi.

How many more will move to this model?

Other micromobility news this week …

Those iconic bright red Jump bikes have been integrated into the Lime app. Why this matters?

Three months ago, Jump’s bikes and scooters disappeared from city streets after Uber unloaded the micromobility company to Lime as part of a complex $170 million fundraising round. When the Jump bikes were finally spotted it was in a recycling yard, where more than 20,000 of them laid in piles, awaiting their demise.

New, unused Jump bikes were tucked away in storage. Lime has started to add those Jump bikes to cities like Denver, London, Paris, Seattle and Washington, D.C. But they were only available through the Uber app. Now, the Jump bikes will show up on the Lime app — as red, not green bike icons. This is the first time since Lime acquired Jump’s assets that the bikes have been integrated into its app.

Deal of the week

The Summer of the SPAC continues with yet another electric automaker turning to a blank check company to go public.

This time it’s Lordstown Motors, the one-year-old Ohio electric automaker that revealed a pickup truck prototype in June. The company said it reached a deal to merge with special-purpose acquisition company DiamondPeak Holdings Corp., with a market value of $1.6 billion.

Electric automakers Nikola Motor and Fisker Inc. have also become public companies through a SPAC over the past two months. Shift Technologies, an online used car marketplace and sensor company Velodyne Lidar, also went public via a SPAC, sidestepping the traditional IPO path.

Axios’ Dan Primack predicted recently that more SPACs are coming. He noted that SPACs have raised $24 billion so far in 2020. What company is next?

Speaking of publicly traded companies, Chinese electric automaker Xpeng filed its F-1 on Friday with the U.S. Securities and Exchange Commission. An F-1 is a required filing for foreign companies that want to be listed on an American stock exchange.

To get up to speed, Xpeng recently raised around $500 million in a Series C+ round. That announcement followed its Series C round of $400 million closed last November.

I haven’t read EVERY SINGLE LINE of the F-1 (I promise more of a deep dive next week). But here’s one highly unusual item. The company has negative gross margins. It brought in revenue, but its cost of sales surpassed revenue. So, negative. This isn’t including other costs like operating expenses or R&D.

Other deals that got my attention this week …

Buckle, a financial services company that insures gig economy workers, including ride-hailing drivers, raised $31 million in Series A funding co-led by Eos Venture Partners and HSCM Bermuda.

ChargePoint, the electric vehicle charging network, raised $127 million in funding in a bid to expand its platform for businesses and fleets in North America and Europe. A mix of existing investors from the oil and gas, utilities and venture industries added to the round, including American Electric Power, Chevron Technology Ventures, Clearvision and Quantum Energy Partners.

Grab raised $200 million from South Korean private equity firm Stic, bringing its total funding so far to more than $10 billion at a valuation of about $14.3 billion, per Bloomberg, which cited unnamed sources. Grab wouldn’t comment about the raise to TechCrunch. Grab did reveal this week that its financial unit is launching a slew of consumer products, including micro-investments, loans, health insurance and a pay-later program.

Streetlight Data Inc., a transportation analytics company, raised $15 million in a Series D round that included Macquarie Capital and Activate Capital as well as existing investors Osage University Partners and Ajax Investment Strategies.

StreetLight Data CEO Laura Schewel told TechCrunch that use of the company’s mobility metrics doubled in just the first month of the pandemic. New volatility of travel — led by a steep COVID-driven decline, then a less-than-gradual return to a ‘new normal,’ and significant mode switching from transit to bikes — has propelled government transportation agencies to turn to StreetLight, according to Schewel.

“We’ve also seen a massive surge in new customers within the thousands of small transportation engineering firms supporting the DOTs, who have been forced by COVID-19 to accelerate their transition to digital data collection (as opposed to going out and doing manual counts or installing devices),” she said. “We’re of course adjusting where we put our resources to be able to serve these growing segments.”

Uber acquired U.K.-based Autocab, which sells SaaS to the taxi and private hire vehicle industry.

Notable reads and other tidbits

Remember when August was the slow news month? Not anymore.

Autonomous cars

Anthony Levandowski, the former Google engineer and serial entrepreneur who was at the center of a lawsuit between Uber and Waymo, has been sentenced to 18 months in prison on one count of stealing trade secrets. Levandowski also agreed to pay $756,499.22 in restitution to Waymo and a fine of $95,000.

He will not have to report to prison until the COVID-19 pandemic is under control.

Levandowski was pushing for home confinement. Judge William Alsup, who also presided over the Uber v. Waymo trial, disagreed. He said home confinement would “[give] a green light to every future brilliant engineer to steal trade secrets. Prison time is the answer to that.”

But as Mark Harris and I discovered, Levandowski is not skulking away. Levandowski recently filed a lawsuit making explosive claims against Waymo and Uber that, if proven, could turn his fortunes around with a multi-billion-dollar payout. Whether this is a last-ditch effort by a desperate man whose career has been upended by his own poor choices or a viable claim against a double-dealing tech titan will be up to the courts to decide.

This new lawsuit, filed as part of Levandowski’s bankruptcy proceedings, mostly focuses on Uber’s agreement to indemnify Levandowski against legal action when it bought his self-driving trucking company, Otto Trucking. It also includes new allegations concerning the settlement that Waymo and Uber reached over trade secret theft claims.

The end goal: Levandowski believes and claims in the lawsuit that he should be awarded earn outs associated with the profits of Uber Freight — the new name of Otto Trucking — an amount that “should be at least $4.128 billion.” He also wants Uber to pay the $179 million sum that was awarded to Google in arbitration.

Connected cars

The Black Hat security conference is that annual event that reminds me of how vulnerable connected cars can be. This year, security researchers at the Sky-Go Team, the car hacking unit at Qihoo 360, found more than a dozen vulnerabilities in a Mercedes-Benz E-Class car that allowed them to remotely open its doors and start the engine.

As our cybersecurity editor Zack Whittaker noted, vehicle security has gotten better over the past half-decade. But Sky-Go’s researchers showed that not even one of the most recent Mercedes-Benz models are impervious to attacks.

Delivery

Amazon’s plan to take a 16% stake in on-demand food delivery app Deliveroo was approved by the U.K.’s competition regulator.

DoorDash launched a digital storefront to sell household goods and other items you might find at a convenience store. The storefront, called DashMart, is available in eight cities throughout the United States. These are essentially micro-fulfillment centers that carry around 2,000 items. Warehouse employees pick and pack the orders, and then delivery workers, known as Dashers, come to collect the order and deliver to the customer.

Uber seems to be popping up all over the place in this week’s newsletter. And delivery is one area I couldn’t ignore. The company reported its second-quarter earnings and buried in the blizzard of numbers (really this earnings report was a 100-year storm of figures) was a nugget that stood out.

Uber’s delivery business — better known as Uber Eats — is now bigger than its original and core ride-hailing division, based on adjusted net revenue. Now, adjusted net revenue tells only a piece of this evolving Uber story. Income, or losses in the case of Uber’s delivery business, are also important.

Still, looking at the change of the past year, and specifically in the past two quarters, it’s clear that Uber’s strategy has shifted. Here are some Q2 numbers to chew one.

- Delivery gross bookings: $6.96 billion

- Mobility gross bookings: $3.05 billion

Here’s how those gross bookings results turned into adjusted net revenue:

- Delivery adjusted net revenue: $885 million

- Mobility adjusted net revenue: $793 million

And how those revenue results turned into adjusted profit, and adjusted losses:

- Delivery adjusted EBITDA: -$232 million

- Mobility adjusted EBITDA: $50 million

Uber CEO Dara Khosrowshahi provided the upshot during the Q2 earnings call. “It’s become clear that we have a hugely valuable hedge across our two core businesses that is a critical advantage in any recovery scenario. When travel restrictions lift we know the mobility trips rebound. If restrictions continue or need to be re-imposed our delivery business will compensate.”

Ride-hailing

Uber and Lyft are facing separate lawsuits from the office of the California Labor Commissioner alleging wage theft. The lawsuits filed this week argue Uber and Lyft are misclassifying their drivers as independent contractors. The end goal: enforce labor practices set forth by California law AB 5 and claw back money allegedly owed to these drivers.

In a separate — yet related matter — Uber and Lyft are fighting to prevent a preliminary injunction that would force the companies to immediately reclassify their drivers as employees. California Superior Court Judge Ethan P. Schulman heard arguments from Uber and Lyft, as well as lawyers representing the people of California, regarding the request for a preliminary injunction.

Car bits

GM revealed the Cadillac Lyriq, an all-electric crossover that aims to set the benchmark for future Cadillacs and propel the brand into a new electrified era.

That new era for Cadillac will have to wait though. The Lyriq will go into production in the U.S. in late 2022, more than two years after its reveal date. The Cadillac Lyriq will be a global product, meaning it will be headed to China as well. Production in China will begin ahead of the U.S., according to Cadillac.

The Lyriq is just one in a roster of 20 electric vehicles that GM plans to bring to market by 2023. The cornerstone of GM’s electric strategy isn’t a specific electric car or truck. It’s a new scalable electric architecture called Ultium that will support a wide range of products across all of its brands, including Buick, Cadillac, Chevrolet and GMC.

Ford is changing up its leadership. The company announced that CEO Jim Hackett is retiring effective October 1, although he’ll stay on as a special advisor until March 2021. Jim Farley, who many believed was being groomed for the position, has been named president and CEO.

Hackett will be leaving Ford three years after being tapped to transform the automaker into a leaner, more competitive and profitable company while investing in technology and shifting toward electrification, automation and connectivity.

Hackett’s turnaround plan was aimed at modernizing the company while making it fitter and included $14 billion in cost reductions over five years. While Hackett accomplished some of those goals, he fell short in others, particularly around the day-to-day toil of making and shipping vehicles.

Speaking of Ford, this column by John Stoll at the WSJ is thought provoking. Ford has struggled to appease shareholders. Stoll argues that the company’s lofty ambition to “lap Tesla” might require extraordinary measures. “Sometimes, the answer is to take back control,” he writes. And that means taking Ford private.

One fun thing

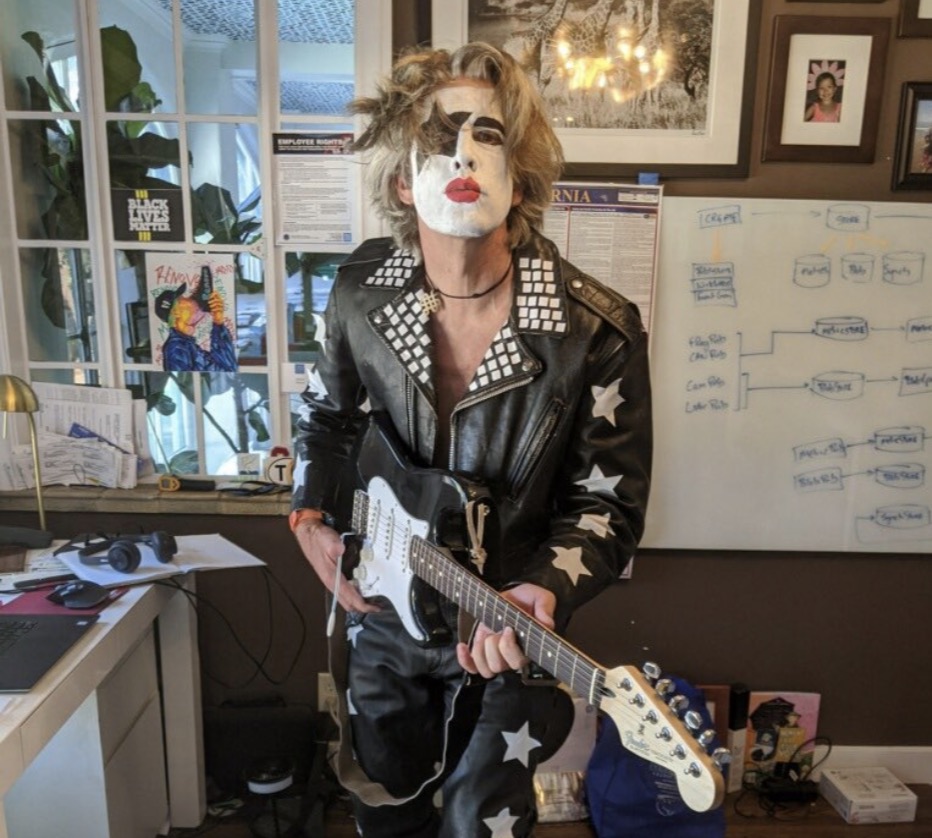

Jason Stinson, the CTO and co-founder of Renovo, a Silicon Valley company that has created a data management platform for self-driving vehicles, has taken his virtual Zoom meetings with employees to a whole new level.

He dresses up for every meeting. And by “dress up,” I’m not talking about the traditional suit and tie. Instead, Gene Simmons from KISS might show up. Or a shark, gondolier, a roller derby Christmas elf, The Greatest American Hero, Pickle Rick from “Rick and Morty” or even The Dude from “The Big Lebowski” may also attend a company meeting.

We would never know about these amazing costumes, if it weren’t for his wife, Aileen Lee, the founder and managing partner of Cowboy Ventures. Thankfully, Lee has been posting photos of Stinson on Twitter. (SF Gate also wrote about Stinson’s meetings.)

Aileen, thank you for your service. Lee is a force within the venture community; you can and should follow her @aileenlee.

[ad_2]

Source link