While you may mostly think about Twilio in the context of its voice and text messaging platform, the company has recently made a number of moves to bolster its IoT platform, which is already one of its fastest-growing business units. To accelerate this push, the company today announced that it quietly acquired IoT platform Electric Imp a few months ago.

Before the acquisition, Electric Imp, which was one of the earlier IoT startups, had raised about $44 million from firms like Ramparts Capital, which led its 2016 Series C round, with participation from Redpoint, Foxconn, Lowercase Capital and PTI Ventures. The two companies did not disclose the price of the acquisition.

Electric Imp makes it easier for businesses to securely connect their IoT devices with their data centers and third-party services. The company was co-founded by Hugo Fiennes, who was the engineering manager for the hardware team at Apple that launched the first iPhone. After managing four phone launches at Apple, he briefly went to Google to work on IoT projects there, but quickly realized that Google had already built the idea he wanted to work on in the company with Android for Things. He also turned down a job at Nest — though he did the design and architecture of their first thermostat, too. His, interest, and that of his co-founders (which include Gmail designer Kevin Fox, who left the company in 2013, and software architect Peter Hartley), was elsewhere, though.

“My worry for IoT was, I didn’t want to be spending many years building something which was just going to be a thermostat,” he said. “Not that a thermostat is not an important thing — it does save lots of energy — but it was more like, ‘oh my God, this technology — IoT, connecting a business service to the real world — allows you to optimize the real world.”

So the idea behind Electric Imp was to build a flexible, architecture-agnostic platform that would take care of all the plumbing to build an IoT system and then manage its life cycle throughout the years. Most businesses struggle with things like updates and, related to that, security, Fiennes argues. That’s what Electric Imp aims to essentially abstract away for its customers.

“We always wanted it to be really accessible,” Fiennes said. “We don’t know all the applications. It’s not like ‘this is gonna be for us to tracking, let’s just chase asset tracking.’ If we know it’s for general purpose, has to be available to anyone, they just buy a dev kit and sign up, whatever, just try it. And a lot of our marketing, for better or for worse, was really just, ‘hey, it’s a great product, right?’ ”

As Fiennes noted, in that respect Electric Imp wasn’t that different from Twilio — and the company actually used Twilio when it demoed its product to potential Series A investors.

Twilio CEO and co-founder Jeff Lawson also noted that the IoT space hasn’t been innovating at the pace of software. “It’s been fun watching Twilio customers invent new connected experiences like shared scooters, and wearables that enable kids to communicate with their parents,” he said. “It reminds me of the explosion of customer engagement use cases Twilio customers invented using our Programmable Voice and SMS APIs. But overall, the IoT industry doesn’t seem to attract innovation at the same rate as software. One possible reason is that experimentation — real experimentation — that is, testing real business models in the wild — remains difficult. By democratizing access to cellular IoT connectivity, we’ve been able to help move things along, but many of the hardest infrastructure problems remain unsolved. With the Electric Imp acquisition, we gain the team and technology needed to make a bigger dent in the problems facing future IoT developers.”

It’s worth noting that Electric Imp isn’t meant to be a platform for high-bandwidth use cases, like streaming video, but more for connecting sensors that produce a more manageable amount of data to the cloud. One of Electric Imp’s customers is Pitney Bowes, which makes postage meters, but you can also think smart grids, river-level monitoring etc. And while Electric Imp’s technology can also be found in smart devices for consumers, Fiennes believes that the real value of the platform isn’t necessary in high-volume products.

“I think it’s kind of like, a lot of those [consumer use cases are] are just like, ‘you can connect it, yes. But why?’ But there’s really a lot of things like, river-level monitoring and a whole load of things which are very hard to deal with without IoT. And they’re not necessarily hugely high volume, which is why a repeatable platform that can be sold to many customers without change is really important because you get to target the niches where there’s a lot of value.”

With this acquisition, Twilio is not just buying a product but also a lot of expertise in building an IoT infrastructure. While the company doesn’t disclose the size of its IoT team, Twilio’s Evan Cummack, the GM of Twilio IT, and Chetan Chaudhary, the VP of Sales for IoT, who together founded the IoT business unit, tell me that a lot of early Twilio employees now work on the IoT side, including Twilio’s very first architect and the company’s first sales rep.

Cummack and Chaudhary told me that after a few years of working at Twilio, the realized there was a lot of untapped potential in IoT for the company.

In the early days of Twilio, both worked on building out Twilio’s strategy for selling to enterprise companies — and to some degree, they are now aiming to use a similar playbook to build out Twilio’s IoT business, though the idea is actually quite a bit older and pre-dates Twilio’s 2016 IPO.

“What I realized was that it was the combination of a really strong go to market with the technical prowess that allowed us to get to the early big wins [for Twilio],” Chaudhary said. “And we had this idea around doing the same thing for cellular connectivity for IoT devices because we were already buying wholesale voice and messaging. And I got to work with some of our carrier relations folks and helping them close some of the connectivity deals. And I was like: ‘Why can’t we sell SIM cards?’ ”

Twilio launched its IoT business in partnership with T-Mobile in 2016. The first product was its programmable wireless service. It then acquired Berlin’s Core Network Dynamics in 2018 to solve another set of problems that IoT developers were facing around connecting their IoT devices.

“What we saw once we started playing in connectivity was that there’s still just a tremendous amount of plumbing that’s not solved for,” Cummack noted. “So you have a tremendous amount of customers having to build their own security stacks, over-the-air update capabilities, secure boot, manufacturing tools, testing, manufacturer, even just things like getting connected to wireless networks, cellular networks and Wi-Fi networks was way too high. And all of this stuff is what I would consider to be platform stuff. It’s all kind of plumbing.”

In its early days Twilio though of the IoT group as a bit of a startup within the company. But that seems to be changing. “Twilio IoT evolved from an internal experiment into a fully fledged business unit with a thriving connectivity business,” Lawson told me. “It has the potential to evolve again into a market-leading platform for the emerging IoT developer community.”

Twilio has already integrated a lot of Electric Imp’s services into its go-to-market strategy, Chaudhary noted. “They’ve already brought […] a lot of credibility in a couple of deals because of their DNA and because of the things that they were able to solve, especially around the embedded design and hardware design, we were able to see some really good synergies early on and now we’ll start to see some net new customers, I think, come from it.”

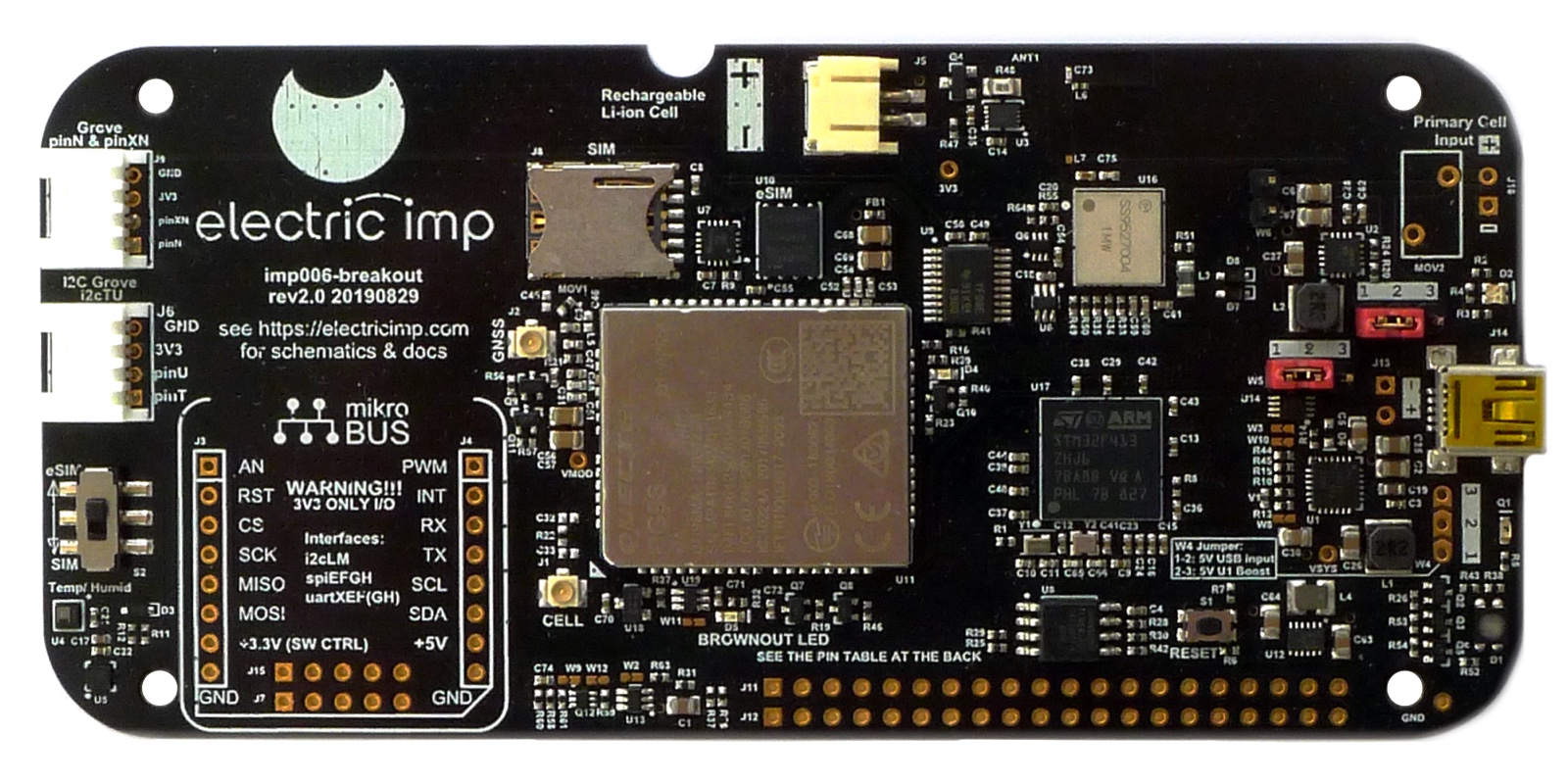

Fiennes will continue at Twilio as a Senior Product Architect, working on IoT and Electric Imp is actually releasing its newest product today: the imp006 breakout board for prototyping IoT products, which — no surprise there — comes with Twilio’s Super SIM for global connectivity already pre-installed.

[ad_2]

Source link