Hundreds of tech-oriented startups worth a billion or more dollars had envisioned successful public offerings before the pandemic hit. But new tech listings slowed to nearly nothing this spring as companies have tried to adjust to the profound changes sweeping the world.

Today, more and more companies are back to their previous plans, with Lemonade and Accolade finding an enthusiastic public this week, following Agora’s pop last Friday, as Alex Wilhelm has been covering.

The first big tech IPO this week was in online insurance, the second in health, and despite both being in promising markets, the valuations are quite a bit higher than their business realities to date. Here’s more, from his analysis on Extra Crunch:

Lemonade is being valued at more than 15x the value of its annualized Q1 revenue despite not sporting the gross margins you might expect investors to demand for it to merit that SaaS valuation. And Accolade only expects to grow by about 20% in Q2 2020 compared to its year-ago results while probably losing more money.

But who cares? The IPO market is standing there with open arms today (there’s always another IPO cliché lurking).

The read of this is impossibly simple: However open we thought that the IPO market was before, it is even more welcoming. For companies on the sidelines, like Palantir, Airbnb, DoorDash and Asana, you have to wonder what they are waiting for. Sure, you can raise more private capital like Palantir and DoorDash have, but so what; if you want to defend your valuation, isn’t this the market that was hoped for?

He also takes a look at a few more companies getting ready to file, including banking software company nCino and GoHealth, an insurance portal that was bought by a private equity firm last year, as well as gaming company DoubleDown Interactive. The general trend seems to be that initial stock pricing has stayed more conservative than how public markets are feeling.

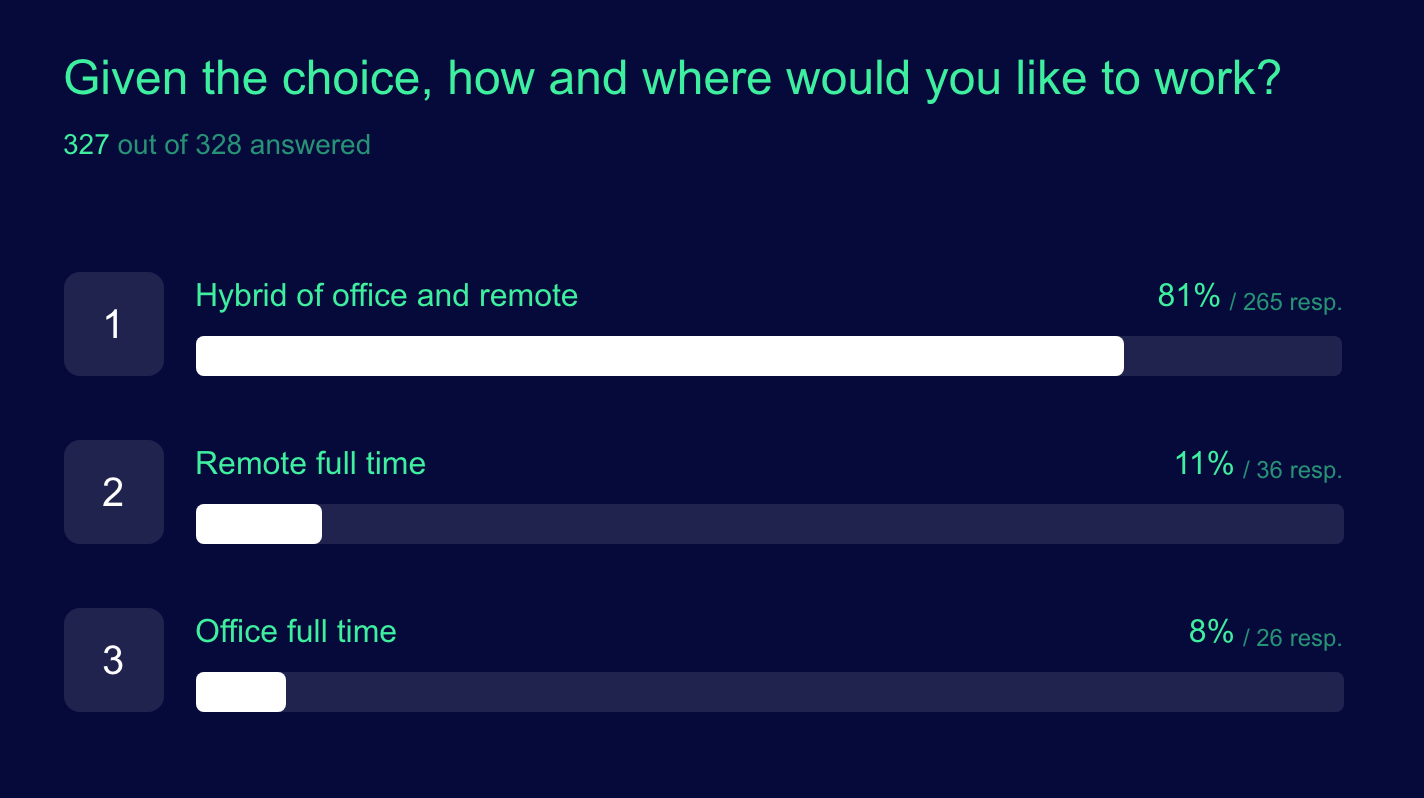

Startup survey shows remote is new normal already

“Early-stage startups are confident of re-opening their offices in the wake of the COVID-19 within the next six months,” writes Mike Butcher for TechCrunch this week. “But there will be changes.” Here’s more from our UK-based editor-at-large:

An exclusive survey compiled by Founders Forum, with TechCrunch, found 63% of those surveyed said they would only re-open in either 1-3 months or 3-6 months — even if the government advises [sic] that it is safe to do so before then. A minority have re-opened their offices, while 10% have closed their office permanently. The full survey results can be found here.

However, there will clearly be long-term impact on the model of office working, with a majority of those surveyed saying they would now move to either a flexible remote working model (some with permanent offices, some without), but only a small number plan a “normal” return to work. A very small number plan to go fully “remote.” Many cited the continuing benefits of face-to-face interaction when trying to build the team culture so crucial with early-stage companies.

Title insurance is getting the tech competition it deserves

A lot of people are thinking harder about homeownership as they wait out quarantines — but real estate is still an old-fashioned industry, layered with complexities and surprising costs that can keep a dream purchase out of reach. Title insurance is a great example. A one-time cost to protect buyers and sellers during the closing process, it can extend the purchase process by a month or two, in addition to potentially adding thousands of dollars in costs. But various new regulations and rulings have combined with the larger trends in SaaS to open up the market. Here’s more, in a detailed guest post for Extra Crunch from Ashley Paston of Bain Capital Ventures:

In a very short period of time, we’ve seen startups take advantage of this new, more competitive landscape by offering solutions to streamline the task of getting title insurance. Qualia, for example, offers an end-to-end platform that connects all parties involved in a real estate transaction, so title agents can manage and coordinate all aspects of the process in real time. San Francisco-based States Title, for example, uses a predictive underwriting engine that produces nearly instantaneous title assessment, dramatically reducing the cost and time required to issue a policy. Qualia and States Title are among several companies hoping to revolutionize title insurance and they reflect the two emerging meta-trends.

The first trend, enablement, consists of companies developing technology designed to integrate with incumbent real estate businesses… The second trend, disruption, consists of companies displacing incumbent real estate business altogether.

Image Credits: Black Innovation Alliance

Tech diversity stays in focus

The tech industry has talked about making its opportunities available to all for many years, and struggled to deliver. But more than a month after George Floyd was killed, this time is still feeling different. One example is 👁👄👁.fm, a viral sort of insidery prank from last weekend that a diverse small group of friends in tech created and turned into a successful grassroots fundraiser for racial justice organizations (it was not a VC fundraising stunt). “In one fell swoop,” veteran product leader Ravi Mehta wrote for TechCrunch, “the team chastised Silicon Valley’s use of exclusivity as a marketing tactic, trolled thirsty VCs for their desire to always be first on the next big thing, deftly leveraged the virality of Twitter to build awareness and channeled that awareness into dollars that will have a real impact on groups too often overlooked.”

Meanwhile, a group of Black startup founders and the Transparent Collective created a public spreadsheet to provide a comprehensive list of every VC who has backed a Black founder in the US, and the umbrella Black Innovation Alliance launched to help hundreds of related Black-focused tech and entrepreneurship organizations connect and support each other. Efforts like these, combined with a real generational willingness to address the structural problems, are what can make the difference finally.

Why AR has mostly failed (so far)

Augmented reality concepts may become a core part of how people live in the future, but the first wave of companies in the space have not fared well. Here’s why, from Lucas Matney on Extra Crunch:

The technology was almost there in a lot of cases, but the real issue was that the stakes to beat the major players to market were so high that many entrants pushed out boring, general consumer products. In a race to be everything for everybody, the industry relied on nascent developer platforms to do the dirty work of building their early use cases, which contributed heavily to nonexistent user adoption.

Instead, he says success will come from nailing the use-cases first, and not messing around with complex developer platforms and expensive hardware.

Around TechCrunch

Hear Charles Hudson explain how to sell an idea (without a product) at Early Stage

Get your pitchdeck critiqued by Accel’s Amy Saper and Bessemer’s Talia Goldberg at Early Stage

Pioneering CRISPR researcher Jennifer Doudna is coming to Disrupt

One week only: Score 4th of July discounts on Disrupt 2020 passes

Sale: Save 25% on annual Extra Crunch membership

Extra Crunch is now available in Greece, Ireland and Portugal

Extra Crunch expands into Romania

Across the week

TechCrunch

Global app revenue jumps to $50B in the first half of 2020, in part due to COVID-19 impacts

Let’s stop COVID-19 from undoing diversity gains

Strap in — a virtual Tour de France is coming this weekend

US suspends export of sensitive tech to Hong Kong as China passes new national security law

India bans TikTok, dozens of other Chinese apps

Extra Crunch

Top LA investors discuss the city’s post-COVID-19 prospects

13 Boston-focused venture capitalists talk green shoots and startup recovery

How $20 billion health care behemoth Blue Shield of California sees startups

From napkin notes to term sheets: A chat with Inspired Capital’s Alexa von Tobel

Are virtual concerts here to stay?

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Before we dive in, don’t forget that the show is on Twitter now, so follow us there if you want to see discarded headline ideas, outtakes from the show that got cut, and more. It’s fun!

Back to task, listen, we’re tired too. But we didn’t let that stop us from packing this week’s Equity to the very gills with news and notes and jokes and fun. Hopefully you can chuckle along with myself and Natasha and Danny and Chris on the dials as we riffed through all of this:

- Journalism, venture capitalists, and not being a colossal jerk: Listen in for more, but there’s once again a brouhaha in the world of technology twitter and media twitter concerning whether journalists should write more positive things about tech companies (no), and if venture capitalists are a bit too thin-skinned for their net worth (yes).

- Lemonade’s IPO went kaboom out of the gate, more than doubling in value. But the CEO isn’t too worried. I spoke with him before we recorded and he was more interested in getting a bedrock of solid, long-term investors than extracting every possible dollar in their raise. And Lemonade had a bunch of money already, so it wasn’t a huge concern.

- We also spent a minute on the possible Uber-Postmates deal, that could get announced early next week. That or Postmates really is serious about going public. We’ll see.

- Next up we had to talk about Mirror, Lululemon, and what’s up with home fitness. Is the trend here to stay? Natasha thinks so, and the rest of the crew are pretty bullish as well. Especially as it is not like we are going to get back to life anytime soon.

- After that it was time to get to a few funding rounds, including the latest from Neo.Tax, and a check-in on the early-stage Lessonbee, which sounds really cool.

- We also crammed in a quick word on Contrary Capital and startup mafias, the Envision accelerator, Discord’s latest $100 million round, and we closed with the Final Luckin Letdown.

- Whew!

Right, that’s our ep. Hugs from the team and have a lovely weekend. You are all tremendous and we appreciate you spending part of your day with the four of us.

Equity drops every Monday at 7:00 AM PT and Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

[ad_2]

Source link