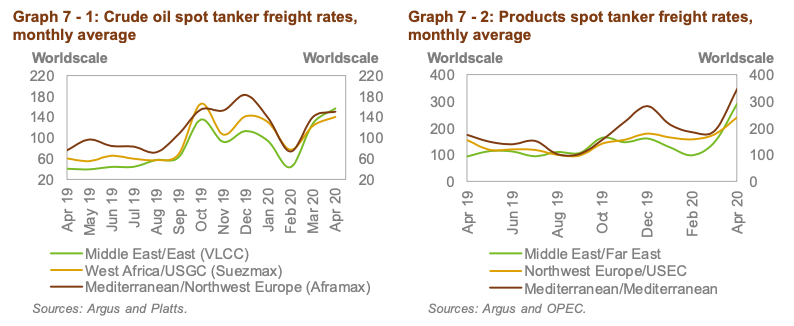

April was a stellar month for the tanker market, with both dirty and clean rates continuing to see spikes during the month, OPEC said in its latest monthly report. The volatile trend that began in early March continued into April, with dirty freight rates peaking early in the month and then trending lower, although remaining at relatively high levels. Rates were supported by a surge in tanker demand that continued through April, driven by low crude prices and a need to push out excess supplies amid concerns about the availability of onshore storage capacity. Meanwhile, clean tanker rates jumped to historic highs in the middle of April, as a collapse in demand due to COVID-19 lockdowns, storage constraints and a strong contango structure for key products gave refiners and traders an incentive to boost product exports and to turn to floating storage. However, these market trends were quickly overwhelmed, sending rates down to more typical levels by the end of the month. The implementation of the historic OPEC+ decision in May along with sharp reductions in capex and drilling activities in the US are expected to weigh on tanker demand in the coming months, although increased floating storage will provide offsetting support.

Spot fixtures

Global spot fixtures fell m-o-m in April, declining by 0.8 mb/d, or 4%, from the high levels seen in the previous month to average 19.1 mb/d. Spot fixtures were broadly in line with the performance seen in the same month last year. Fixtures remained at high levels supported by crude bookings from major exporters, which picked up from the previous month.

OPEC spot fixtures averaged 13.79 mb/d in April, broadly in line the previous month, but an increase of 0.6 mb/d or 5% y-o-y. Fixtures from the Middle East-to-East were also stable m-o-m in April at 7.9 mb/d. Y-o-y, fixtures on the route were 1.1 mb/d, or 16%, higher. Middle East-to-West fixtures declined 14% m-o-m in April coming off the substantial gain seen in the previous month. Fixtures on the route averaged 2.5 mb/d, representing an increase of 0.7 mb/d, or 41%, over the same month last year. Outside of the Middle East, fixtures recovered from the previous month’s decline, rising 0.5 mb/d or 17% m-o-m to average 3.4 mb/d in April. In annual terms, fixtures were sharply lower, registering a decline of 1.2 mb/d or 26%.

Sailings and arrivals

OPEC sailings jumped 1.9 mb/d in April to average 25.74 mb/d and increased1.1 mb/d, or 5%, compared to April 2019. Middle East sailings rose 0.6 mb/d, or 3%, m-om to average 17.75 mb/d for a y-o-y gain of 0.6 mb/d or 4%. Crude arrivals were higher in April on all routes outside the Far East. Arrivals in West Asia saw the highest gains, increasing 6% m-o-m, although remaining broadly at the level seen in April last year. Arrivals in North America rose 1% m-o-m to average 7.9 mb/d. Y-o-y, arrivals were still 26% lower on the route. Arrivals in Europe were broadly consistent m-o-m in April averaging 11.0 mb/d In contrast, Far East arrivals declined 9% m-o-m to average 8.0 mb/d in April, but were broadly in line with the level achieved in the same month last year.

Dirty tanker freight rates

Very large crude carriers (VLCCs)

The positive momentum that began in March continued on into April with an increase in cargoes and demand for floating storage supporting rates. As a result, VLCC spot freight rates saw further gains across the board during the month, with rates rising by 16% on average m-o-m. Rates on the Middle East-to-East route led gains in April, up 23% m-o-m to average WS156 and were up three-fold compared to the same month last year. Freight rates for tankers operating on the Middle East-to-West route rose 2% m-o-m in April, on top of the substantial jump seen the month before, to average WS103. Y-o-y, rates were almost five-times as high. Increased activity also tightened the West Africa-to-East route, where rates rose 20% to WS145, representing a gain of more than 200% compared with April 2019.

Suezmax

Suezmax rates also benefited from the higher activity, with average spot freight rates increasing 16% m-o-m on average in April. Y-o-y, rates were up 118%. Rates for tankers operating on the West Africa-to-US Gulf Coast (USGC) route averaged WS140 in April, an increase of 14% over the month before. Y-o-y, rates were 133% higher than in April last year. The Northwest Europe (NWE)-to-USGC route rose 4% m-o-m to average WS102, representing a 100% jump compared to the same month last year.

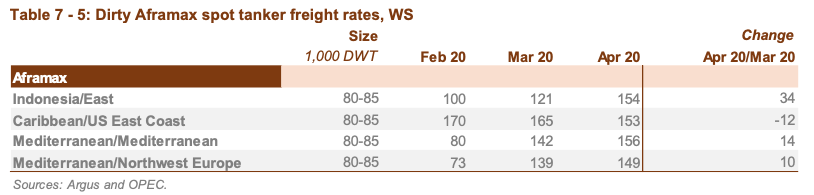

Aframax

Aframax rates rose 8% in April, mirroring gains in other classes to a lesser extent. Compared to the same month last year, rates were 85% higher. The Indonesia-to-East route led Aframax gains, increasing 28% to average WS154. The Cross-Med route rose 10% to average WS149, while the Mediterranean-to-NWE route gained 7% to average WS156.

Only the Caribbean to US East Coast (USEC) route experienced a decline m-o-m, dropping 7% to average WS153, but still managed a strong y-o-y increase of 95% to average WS153.

Nikos Roussanoglou, Hellenic Shipping News Worldwide