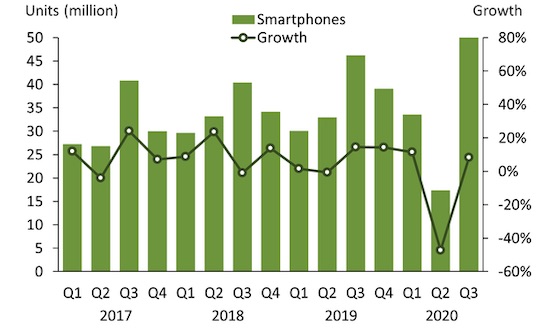

Smartphone shipments reached an all-time high in India in the quarter that ended in September this year as the world’s second largest handset market remained fully open during the period after initial lockdowns due to the coronavirus, according to a new report.

About 50 million smartphones shipped in India in Q3 2020, a new quarterly record for the country where about 17.3 million smartphone units shipped in Q2 (during two-thirds of the period much of the country was under lockdown) and 33.5 million units shipped in Q1 this year, research firm Canalys said on Thursday.

Xiaomi, which assumed the No.1 smartphone spot in India in late 2018, continues to maintain its dominance in the country. It commanded 26.1% of the smartphone market in India, exceeding Samsung’s 20.4%, Vivo’s 17.6%, and Realme’s 17.4%, the marketing research firm said.

Image Credits: Canalys

But the market, which was severely disrupted by the coronavirus, is set to see some more shifts. Research firm Counterpoint said last week that Samsung had regained the top spot in India in the quarter that ended in September. (Counterpoint plans to share the full report later this month.)

According to Counterpoint, Samsung has benefited from its recent aggressive push into online sales and from the rising anti-China sentiments in India.

The geo-political tension between India and China has incentivised many consumers in India to opt for local brands or those with headquarters based in U.S. and South Korea. And local smartphone firms, which lost the market to Chinese giants (that command more than 80% of the market today) five years ago, are planning a come back.

Indian brand Micromax, which once ruled the market, said this month that it is gearing up to launch a new smartphone sub-brand called “In.” Rahul Sharma, the head of Micromax, said the company is investing $67.9 million in the new smartphone brand.

In a video he posted on Twitter last week, Sharma said Chinese smartphone makers killed the local smartphone brands but it was now time to fight back. “Our endeavour is to bring India on the global smartphone map again with ‘in’ mobiles,” he said in a statement.

India also recently approved applications from 16 smartphone and other electronics companies for a $6.65 billion incentives program under New Delhi’s federal plan to boost domestic smartphone production over the next five years. Foxconn (and two other Apple contract partners), Samsung, Micromax, and Lava (also an Indian brand) are among the companies that will be permitted to avail the incentives.

Missing from the list are Chinese smartphone makers such as Oppo, Vivo, OnePlus and Realme.