Editor’s note: Be sure to check out our on-demand webinar, Automating Resilience for Banking and Financial Services.

Banking and capital markets are known as the frontrunners in Robotic Process Automation (RPA). And for good reason. There are many industry challenges that drive banking and capital markets to pursue automation initiatives. These include an expansive and fragmented IT architecture landscape, and complex middle- and back-offices processes.

The toughest challenge is keeping up with regulatory compliance demands. The post-2008 financial crisis regulation clamp-down has resulted in the highest investment in compliance technology and operations in the industry’s history. Since 2008, banks are reputed to have spent over $321 billion on compliance operations and fines. For the industry overall, it is estimated that banks spend approximately $270 billion annually on compliance operations.

These costs, compounded by regulatory fines, impact revenue. Intensifying regulatory requirements slow processes down and negatively impact the customer experience. Banks are under intense pressure to find new and better ways to manage compliance. Throwing people at the problem, however, is not the answer.

RPA can enable banking and capital markets firms to break free from their current compliance management limitations. If banking and capital markets are going to transform their compliance operations, however, they need the right technology strategy and expanded RPA use cases.

Over the last few months, I’ve had many conversations with customers about a new wave of RPA opportunities. These new use cases:

are based on a more complete and expansive RPA technology offering

remove the original RPA constraints of ‘wave 1’ implementations

allow banks to scale RPA across their institutions

I wanted to share with a wider audience how I’ve been advising customers about new banking RPA opportunities with this blog post. Below you’ll find a collection of common questions and conversations, and my perspectives on each.

The initial automation use cases led RPA owners into a corner, and in some cases – made them feel stuck with little to no ROI.

All banking segments – consumer, commercial and wholesale, and capital markets – were early adopters of RPA, however, there are RPA skeptics and critics in the industry. These folks led the first wave of RPA projects and had a steep learning curve. They were also disappointed by the lack of return on investment. In some cases, their RPA deployments may even be sitting in a corner.

Yes, a lot of banking institutions feel stuck. One reason for this is that they are not able to find use cases that their platform can actually handle. This is due to limitations of the product they initially invested in two to three years back. Another reason is that initial projects failed to deliver, and so people are simply not looking for new use cases or automation opportunities. Or they feel blocked because the speed to market isn’t there. The ease of use factor is also missing. As a result, the RPA solutions that they have at their disposal take too long to deliver results. So, they are better off focusing their efforts on other projects. It has to be frustrating to want to capitalize on an RPA investment, and know that others are leveraging the technology successfully– but that effective use has been a business miss in the past.

There are common RPA experiences across banking and capital markets firms over the last few years; they faced a lot of challenges with their first RPA project rollouts.

The first problem that RPA initiative owners had was that they only looked at one type of use case, and this was unattended robots. There are more use cases now including attended robots and hybrid robots. The next problem was that the technology they were using lacked extensibility and flexibility. In today’s RPA ecosystem, there are many more RPA platform partners to address this issue than five years ago. The final problem that I would call out is that a lot of RPA solutions that first came out didn’t have an evolving roadmap including pragmatic artificial intelligence (AI) capabilities. What RPA vendors and customers alike have realized is that flexibility and extensibility are needed to support complex use cases. The combination of these problems led to setbacks and failures. As a result, many banking and capital markets RPA initiative owners are frustrated with their initial project results.

The ‘no work is ever wasted’ maxim applies to RPA early adopters: how to think about first project learnings.

I am a fan of the axiom ‘no work is ever wasted.’ Particularly when lessons learned can be used down the road. Banking and capital market firms now have a strong understanding of how to implement RPA. They can clearly see what the gaps were in the first wave of RPA technology solutions. There are a lot of customer-facing, front-office, or middle-office processes that were not touched by RPA. Also, end-to-end processing in financial advisory, underwriting, customer servicing, equity research, and especially regulatory reporting, were just not possible. Finally, hybrid automation didn’t have good results in the first wave.

I’m seeing that customers are taking advantage of what they learned.

Banks and capital markets firms have learned from having previous issues with RPA deployment and adoption speed. These really affected adoption across critical business functions for early adopters, particularly those processes that needed to adapt to the external environment. As an example, risk and compliance functions need both speed and agility to meet the demands of a dynamic regulatory landscape. Also, consumer banks have to grapple with changing data privacy regulations. Wholesale banks have similar challenges in clearing their anti-money laundering (AML)/KYC backlogs. Capital market firms must manage the challenges of Markets in Financial Instruments Directive (MiFID) norms.

Banking institutions have also come to realize that cross-group collaboration was missing on their first RPA ventures. They now understand that collaboration is needed to look across the entire operations landscape. This is best exemplified in compliance use cases which need to identify opportunities across multiple lines of defense.

One example of this is an operations team executing business controls collaborating with two other business organizations. Another example is compliance management run by both the chief commercial officer (CCO) and internal audit teams where the goal is to unearth automation opportunities to reduce exposure.

Another notable example is client onboarding where client-facing teams, AML, and customer onboarding operations teams could work together to help improve all three – regulatory risk exposure, onboarding costs, and customer experience.

These are incredibly valuable learnings that position banking institutions to get to better outcomes. They are now able to identify the highest-value automation opportunities. They are also able to define the optimal model to implement RPA and choose the right solution to deliver more complex RPA.

Related read: eurobank Streamlines Operations and Boosts Productivity with RPA

How should banking and capital markets RPA initiative owners reassess new RPA opportunities?

I think one thing that banking institutions need to consider is moving beyond a ‘single lens’ perspective. This applies to RPA opportunity use case identification and the value driver itself. The initial way that banking and capital markets enterprises looked at automation use cases was strictly at unattended scenarios.

I’ll give you an example for capital markets institutions. Let’s take a trade reconciliation or a position reconciliation situation where an unattended automation will make sense at the outset. However, if you have to expand beyond a handful of use cases, you will have to add additional lenses, and also look at those use cases that require a human to trigger or validate part of a process. This expanded process requires either an attended robot or a hybrid robot use case.

In a nutshell, if you look at more complex use cases that involve different types of automation, this expands your automation opportunities. Given that technology is evolving and solutions in the market have taken strides, it makes sense for companies to now expand the scope and look at more complex processes, and not just ‘plain vanilla’ RPA.

What role does ‘human-in-the-loop’ play in expanding RPA opportunities?

Initially, RPA projects were focused on operational efficiencies in the back office. Firms now need to also look at the front and middle office for RPA opportunities that were not initially available to them when they were first adopting this new technology. A whole host of RPA opportunities have been uncovered with hybrid automation technology that now allows for a human to provide input or make a decision in the middle of an automated process.

For example, in consumer banking, we’ve seen this model utilized by teams conducting suspicious activity investigations. In this particular use case, once a suspicious activity alert has been triggered, a Robot automatically extracts customer data from core banking applications, in addition to any history of suspicious activity reports. The Robot then compiles this information in one centralized dashboard for an analyst (human-in-the-loop) to review and make a decision. Once a decision has been made, the analyst then prompts the Robot to perform the required follow-up actions, like sending customer notifications and logging of all actions in the fraud management system.

How will the use of pragmatic AI help banks start to scale RPA?

The AI lens is a whole new frontier. I recommend that banking institutions embrace that AI is actually working as a first step! This is an important part of the reset we’ve talked about so far. The opportunity is larger than ever before. A lot of this is due to unstructured data coming from emails, client contracts, International Swaps and Derivatives Association (ISDA) documents, trade documents, etc.

RPA integration with AI skills from best-in-class technology providers can solve very difficult document understanding use cases for banks. Additionally, AI capabilities enable auto-discovery of potential automations which was not possible earlier. These are the drivers of expanded scope, and a faster and easier time to market.

Readers may have heard about a tool called an ‘RPA Heatmap.’ How are RPA Heatmaps used?

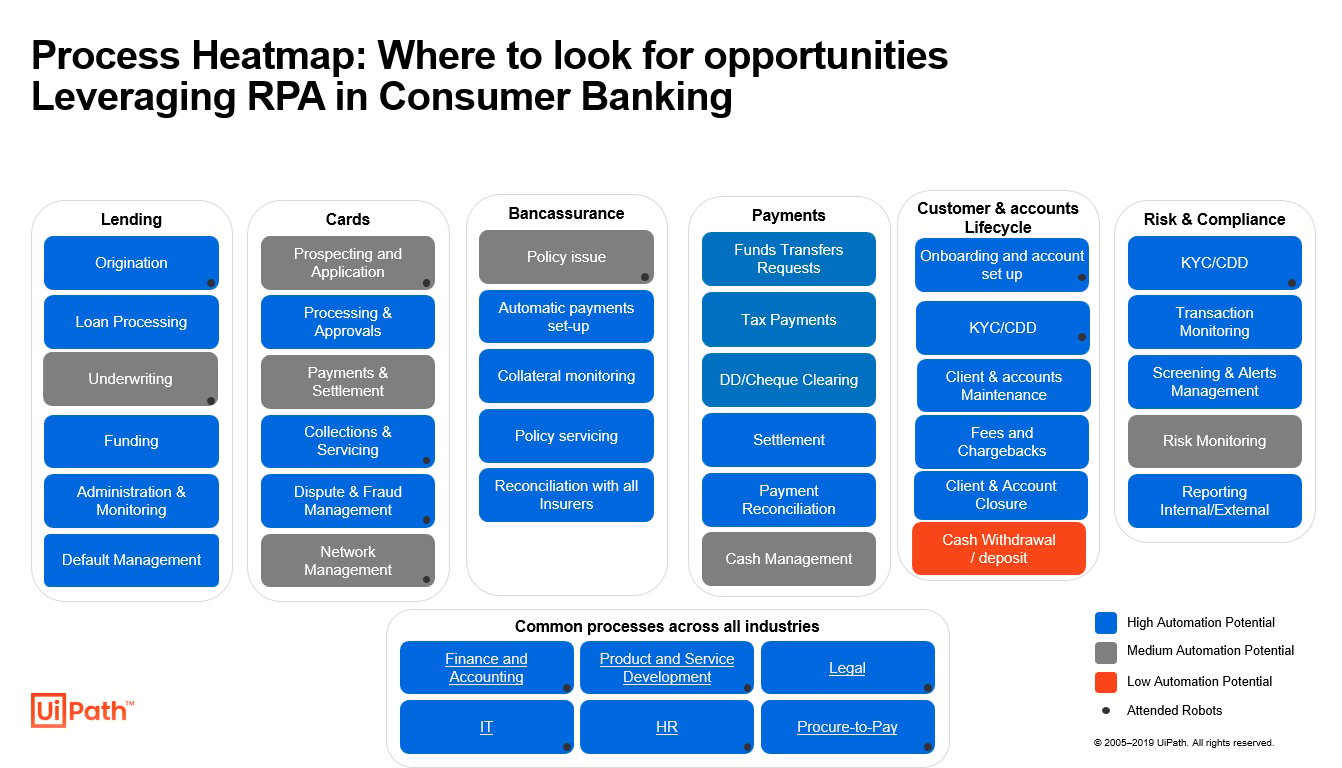

Using an RPA Heatmap is a great way to guide banking and capital markets institutions on where to look for RPA opportunities.

Heatmaps introduce guiding dimensions using three categories:

1. Business functions

2. Type of Robot (attended and unattended)

3. Level of effort

Let’s use the Consumer Banking RPA Heatmap as our example today (image above). The Heatmap helps consumer banking firms to navigate across three dimensions. The first dimension is identifying the automation opportunities that provide the best value for investment across the landscape. Are these in a contact center channel, in client services, in a front office?

Then, moving on to the second dimension, you can consider across all automation opportunities, which are the ones which can use attended automation? As discussed, attended automation was definitely a filtering consideration that was missing in the initial RPA project rollouts. You can see how the Heatmap addresses that conversation very directly.

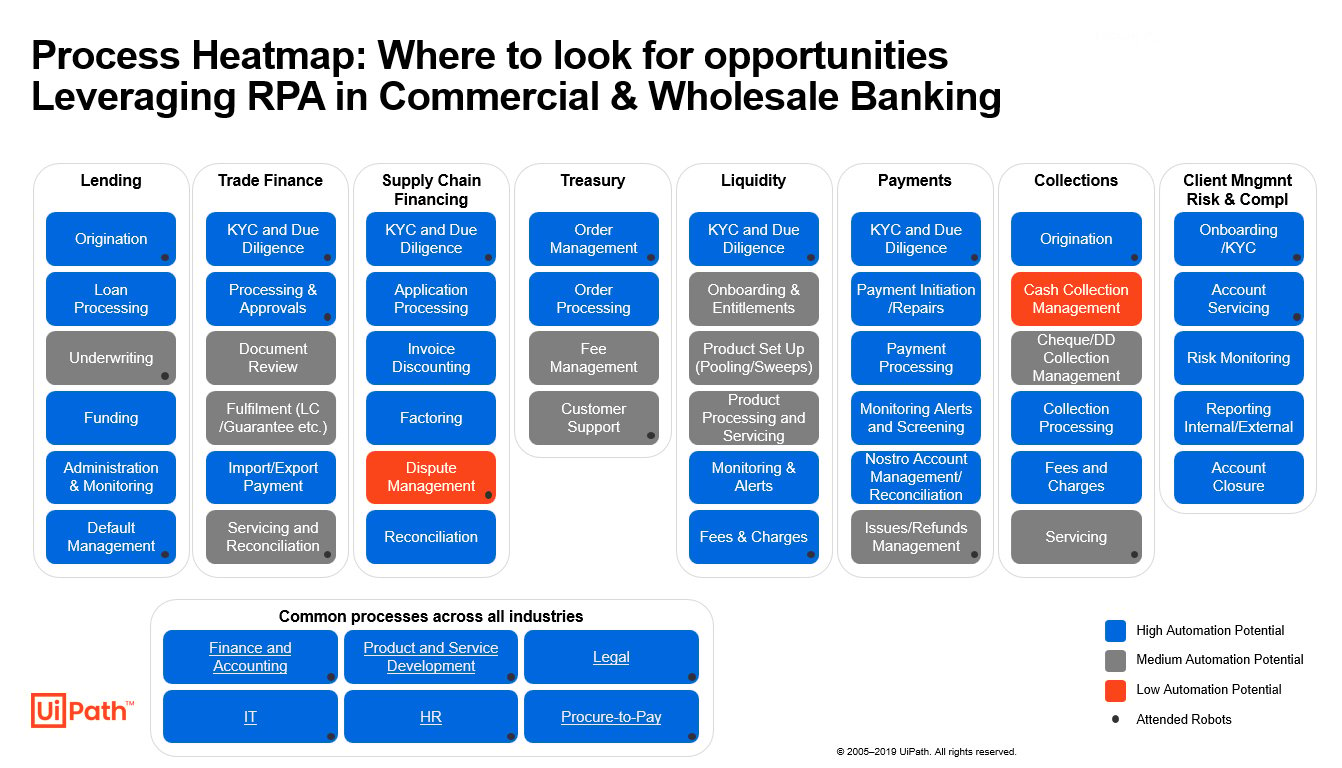

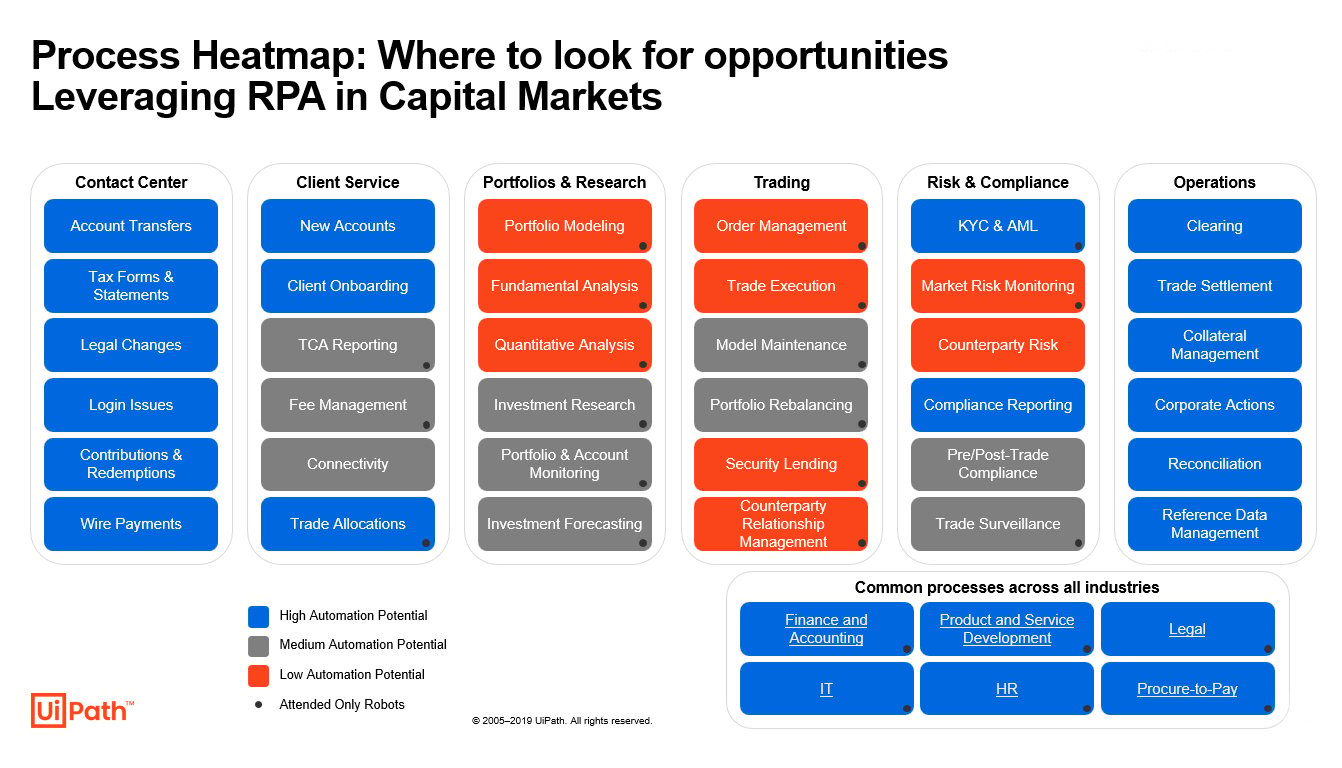

Additional heatmap examples for commercial and wholesale banking and capital markets are provided below:

What are the biggest RPA use case opportunities in banking and capital markets?

I’ll describe the three biggest opportunities. The first is client onboarding. Today it takes anywhere between 20 to 60 days—in some cases even 80 days—to onboard an institutional client. The revenue opportunity cost here is massive and the client experience is very poor. RPA can help onboarding teams reduce the amount of time spent on manual work required to set up client accounts. This can make the onboarding process as frictionless as possible for clients, shortening the amount of time before revenue-producing activity can begin.

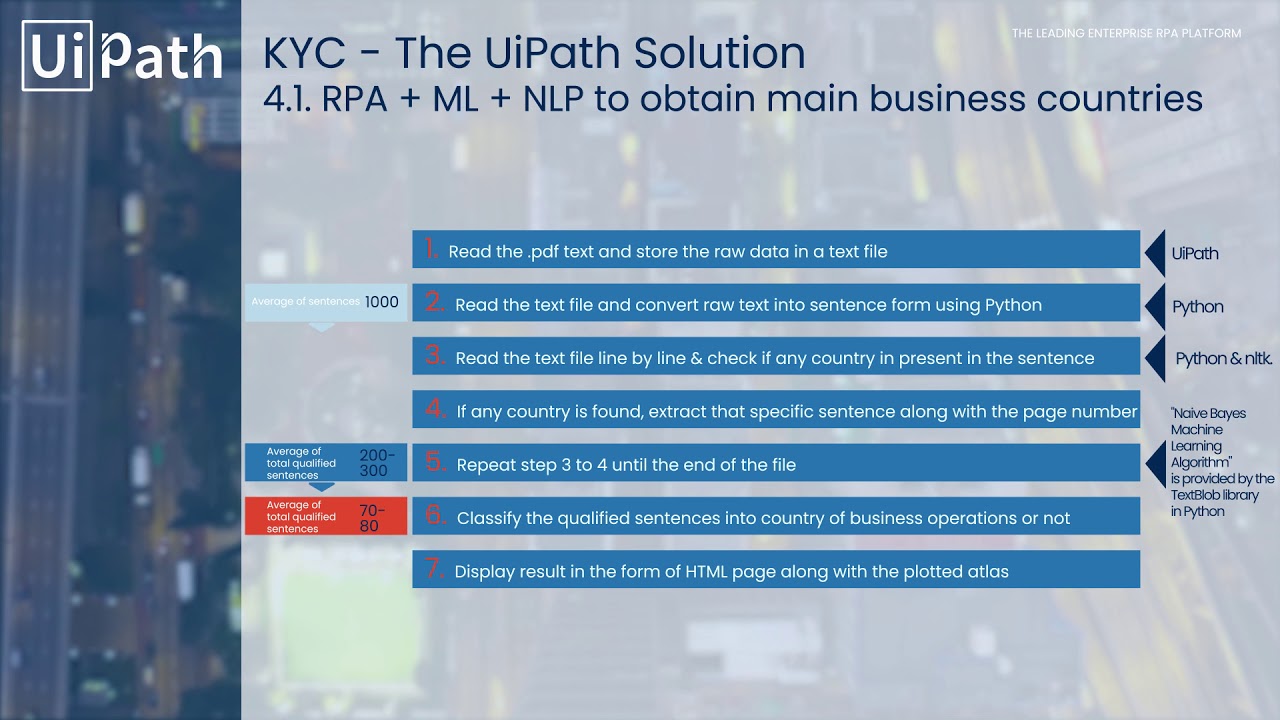

The second opportunity is in the area of KYC regulatory and compliance work. Right now, a lot of burden is placed upon compliance teams to perform a high volume of important tasks like negative news screenings, beneficial owner extraction, and other enhanced client due diligence. These processes are extremely sensitive, and any errors or omissions can have significant financial or reputational consequences. RPA can help improve accuracy within these processes and can help compliance teams focus their efforts on analyzing those outliers that may pose the most risk.

The third opportunity is enterprise-wide operations. All banking and capital markets institutions have common activities. These include reconciliations between accounts or systems and reporting of different varieties. While the specifics of these processes vary by institution, the manual work performed within these functions is similar. Many of these processes are great starting points given the repetitive, rules-based nature of the tasks.

Conclusion

As the intrepid RPA users, banks have had a steep learning curve. But banking and capital markets firms can’t afford to not focus on a scalable RPA strategy due to regulatory requirements.

With new use cases using attended (human-in-the-loop) and hybrid robots—and more complete and AI-enhanced technology—they are well-positioned to take advantage of new RPA opportunities. This is crucially important to tackling compliance operations, where faster and easier implementations are needed.

The second wave of RPA will reduce the burden of the regulatory landscape. It will also justify RPA as a digital transformation value driver. Learn more about the UiPath Enterprise RPA Platform for banking and capital markets.

Amit Kumar is director of financial services at UiPath.