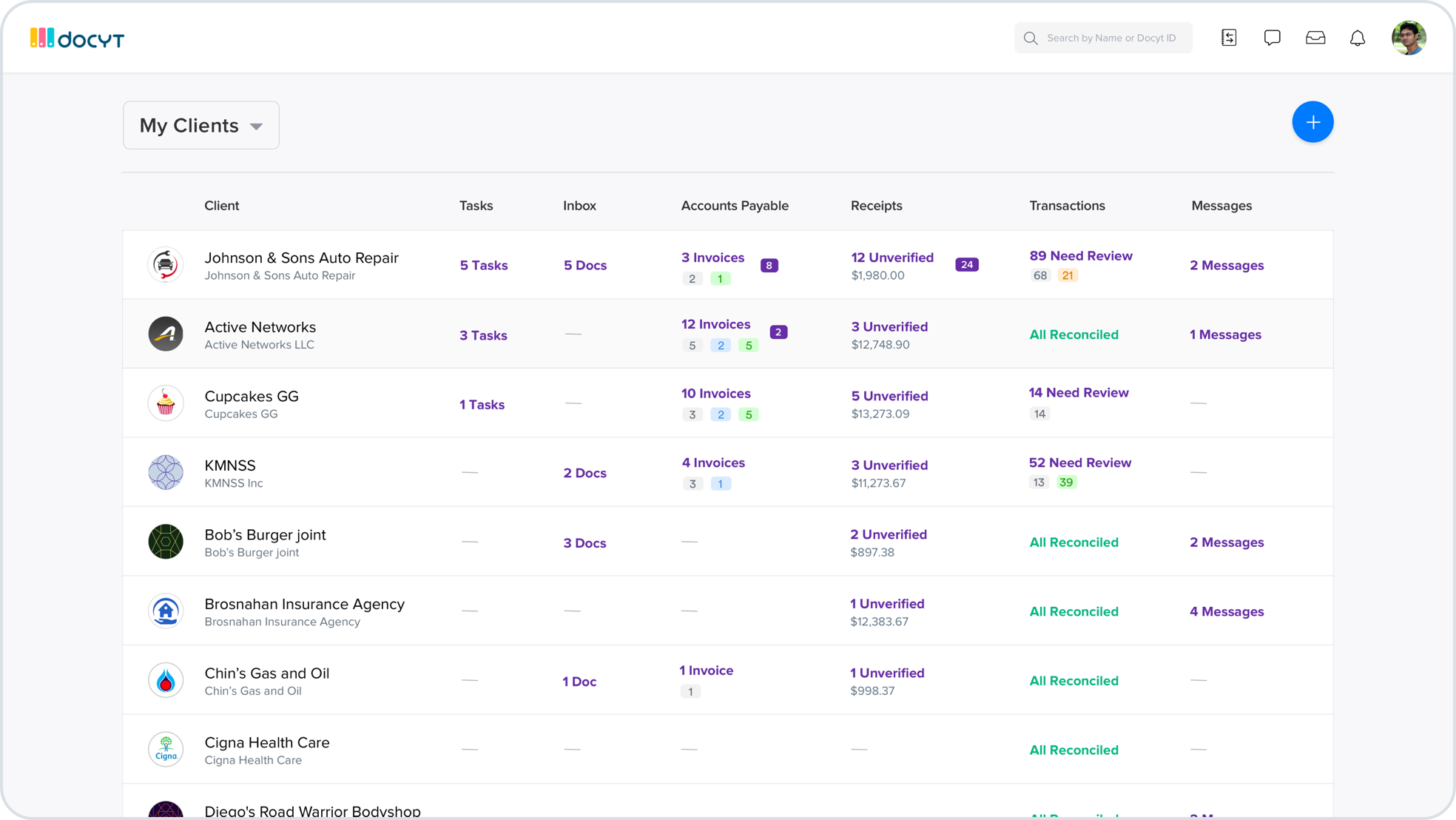

Accounting isn’t a topic that most people can get excited about — probably not even most accountants. But if you’re running any kind of business, there’s just no way around it. Santa Clara-based Docyt wants to make the life of small and medium business owners (and their accounting firms) a bit easier by using machine learning to handle a lot of the routine tasks around collecting financial data, digitizing receipts, categorization and — maybe most importantly — reconciliation.

The company today announced that it has raised a $1.5 million seed-extension round led by First Rays Venture Partners with participation from Morado Ventures and a group of angel investors. Docyt (pronounced ‘docket’) had previously raised a $2.2 million seed round from Morado Ventures, AME Cloud Ventures, Westwave Capital, Xplorer Capital, Tuesday and angel investors. The company plans to use the new investment to accelerate its customer growth.

At first glance, it may seem like Docyt competes with the likes of QuickBooks, which is pretty much the de facto standard for small business accounting. But Docyt co-founder and CTO Sugam Pandey tells me that he thinks of the service as a partner to the likes of QuickBooks.

“Docyt is a product for the small business owners who finds accounting very complex, who are very experienced on howto run and grow their business, but not really an expert in accounting. At the same time, businesses who are graduating out of QuickBooks — small business owners sometimes become mid-sized enterprises as well — […] they start growing out of their accounting systems like QuickBooks and looking for more sophisticated systems like NetSuite and Sage. And Docyt fits in in that space as well, extending the life of QuickBooks for such business owners so they don’t have to change their systems.”

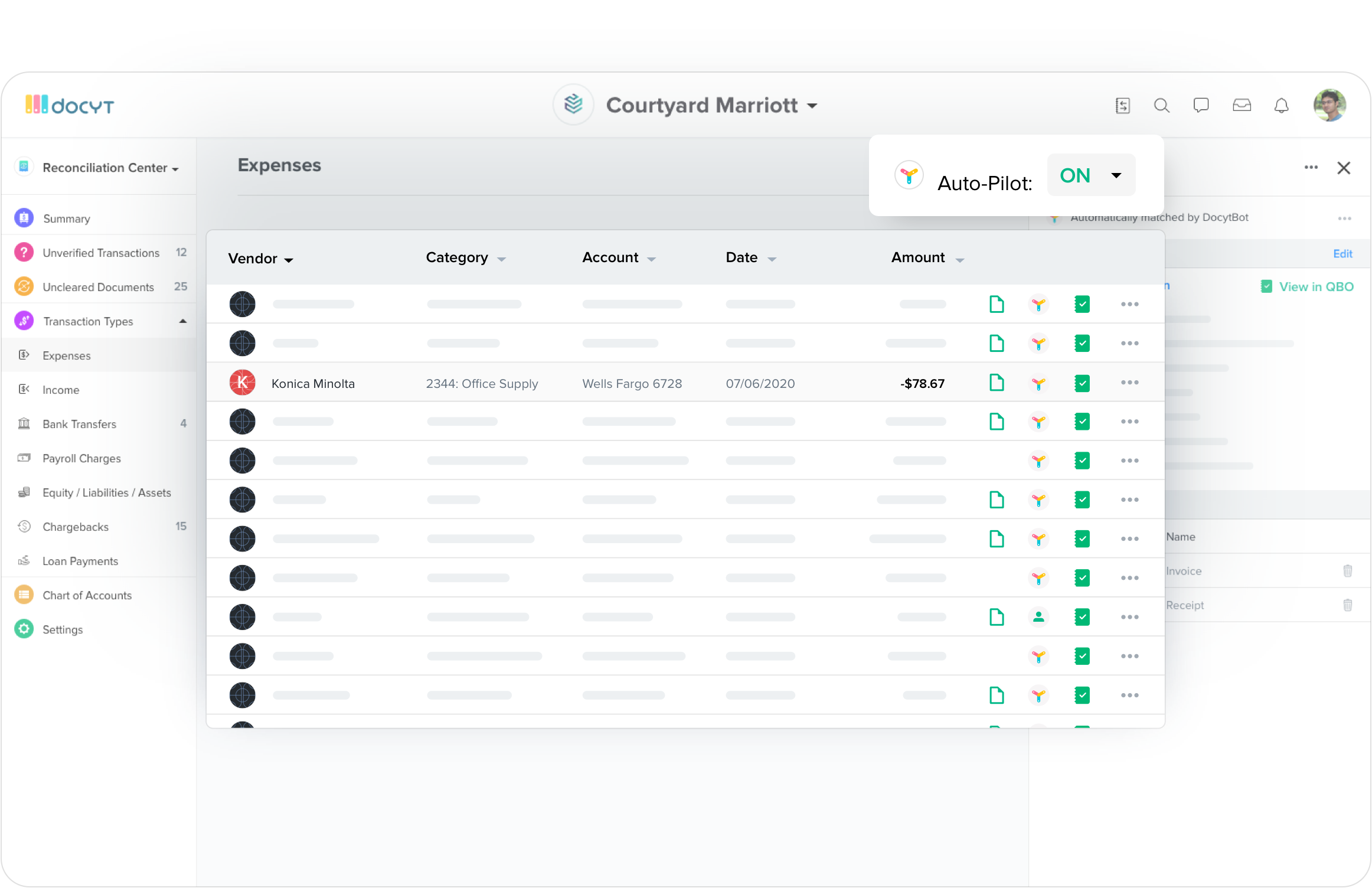

In its earliest days, Docyt was a secure document sharing platform with a focus on mobile. Some of this is still in the company’s DNA, with its focus on being able to pull in financial documents and then reconciling that with a business’ bank transactions. While other systems may put the emphasis on transaction data, Docyt’s emphasis is on documents. That means you can forward an emailed receipt to the service, for example, and it can automatically attach this to a financial transaction from your credit card or bank statement (the service uses Plaid to pull in this data).

For new transactions, you sometimes have to train the system by entering some of this information by hand, but over time, Docyt should be able to do most of this automatically and then sync your data with QuickBooks.

“Docyt is the first company to apply AI across the entire accounting stack,” said Amit Sridharan, Founding General Partner at First Rays Venture Partners. “Docyt software’s AI-powered data extraction, auto categorization and auto reconciliation is unparalleled. It’s an enterprise-level, powerful solution that’s affordable and accessible to small and medium businesses.”