11 August 2020. N.I Malik, Strategic Business Analyst @ Elite Aviation.

Elite Aviation Research and Development wing will always provide you accurate & real time analysis to help you out in making critical decisions & forecasting your plans ahead. As we are already aware that only Real-Time Analysis and assessment allow you to take important & critical decisions.

Cargo Shipping aircraft is currently in a phase of shortage to carry higher capacity luggage, and rates are higher as well. It has been predicted that IATA or International Air Transport Association that Cargo aircraft are not going to be able to return to their normal capacity for pandemic situations anytime sooner than 2024.

As far as passenger aircraft are being concerned then they have at least 50% of cargo space more than global cargo-carrying policy, but there is a problem with such aircraft that they are restricted to stay on the ground from March.It has been predicted b IATA that to reach the same air traffic as it was in 2019 it will take at least 3 more years, or maybe four depending on the COVID-19 situation. As this virus has started spreading once again in developing countries like the USA.

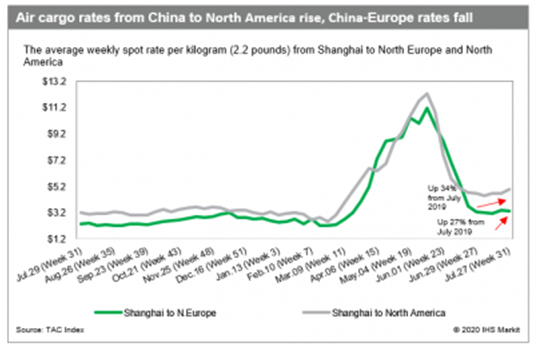

Due to the rise in infection cases in the US, there has been a drastic rise in the cargo shipping rate to at least 6.4%, and that has all happened due to conserved sea shipping capacity. Currently, the rate for one kilogram shipping rate is $4.97, and the recorded highest shipping rate this year has been $12.27 for a single kilogram package compared to the last year.

As far as Trans-Atlantic prices are being concerned they have increased their current shipping prices by $3.87 for one kilogram which is 3% more than before. Whereas if average shipping rates are being considered from Shanghai to the European countries then the rates a bit low which are $3.32 for one kilogram, and this rise is 2.3%.

It has also been believed by the forwarders that air shipping is not going to return to the previous status of belly cargo shipping anytime sooner, and due to that, there will be a constant rise in the shipping prices. It has also been stated by CEVA to JOC.com that it is not possible for air shipping capacity to return to the capacity of last year antitime sooner.

He also states that “As long as there are travel restriction and passenger aircraft are grounded, we will not enjoy the capacity we have before the crisis. The rules of the game have changed, and the air freight market is expected to be capacity-driven until 2023”.

Belly pain to continue

CEO of Kuehne + Nagel International AG, Detlef Trefzger also stated that “The belly cargo that was coming back into the market was in short and medium-haul travel. And that doesn’t help us. This is not where we transact the majority of our business.” He also stated during First half earning Call on 21st July that, “And for International Shippers, that short and medium-haul belly capacity won’t alleviate tightness and rate pressure on long-haul routes.”

Further, he added to his statement that’ “I would expect in the second semester that 60% to 70% of all volume will be transported by freighters. Belly will not recover soon. It will take maybe two years before we see significant network activity that allows for using belly capacity again.”

According to Managing Director of Janel Group in Hong Kong., Paul Tsui, that before cargo fighters were the main source for shipping, but now when Trans-Pacific is also being used then there is no doubt that prices will keep on increasing with o sooner expectations for them to come down. HE also states that “My expectation is that COVID-19 [impacts] will be with us for the whole year and will likely cross over to 2021.”

Airlines based in Asia carry almost 40 percent of the global air cargo tonnage, much of that below decks of widebody passenger planes. In June, however, the Association of Asia Pacific Airlines (AAPA) reported a 98 percent decline in the number of passengers compared with the same month last year. Air cargo volume was down 20 percent in June, despite all available freighter aircraft being in service.

Subhas Menon, AAPA director-general, said the uncertainty surrounding the potential resumption of passenger travel is putting the airline industry in “a perilous situation.”

“The prospect of a recovery in travel markets during the second half of the year is increasingly uncertain, as governments grapple with a resurgence of local infections, with the re-imposition of community lockdowns and further tightening of travel restrictions,” Menon said in a statement Tuesday.

The shortage of belly capacity will become particularly acute on the trans-Pacific and Asia-Europe trades in the fourth quarter with several smartphone and electronics product launches scheduled, said Michael Steen, chief commercial officer at Atlas Air Worldwide. He told a webinar earlier this month that the product launches would give the industry a traditional peak season at the end of the year.

But he warned that rising demand for general air cargo in a capacity-constrained environment in the fourth quarter could clash with the development of a COVID-19 vaccine. Should a vaccine be ready for public use later this year, it would require a massive distribution effort that the air cargo supply chain would struggle to support, he said.

“In the near-term, we will have to get the vaccines to the market,” Steen told the webinar. “We will see spikes driven by commercial demand, and the vaccines would be layered on top of that.”