The Stock Pennant Pattern is a popular chart pattern among traders, signaling potential continuation in the direction of the current trend.

This pattern forms during periods of consolidation following a strong price movement, creating a small symmetrical triangle.

Analyzing this pattern involves identifying its key features, such as converging trendlines and decreasing volume, which precede a breakout.

In this article, we will explore the analysis of the Stock Pennant Pattern and provide practical trading tips to help you capitalize on these patterns effectively.

What is a Pennant Pattern?

A Pennant Pattern takes shape during a trend in the stock market as a small, symmetrical triangle that implies a continuation of this trend.

It shows up after a significant price movement, creating what traders name as a flagpole.

This pattern forms due to market consolidation, where feelings and viewpoints among traders vary about the forthcoming direction of stock prices.

Types of Pennant Patterns

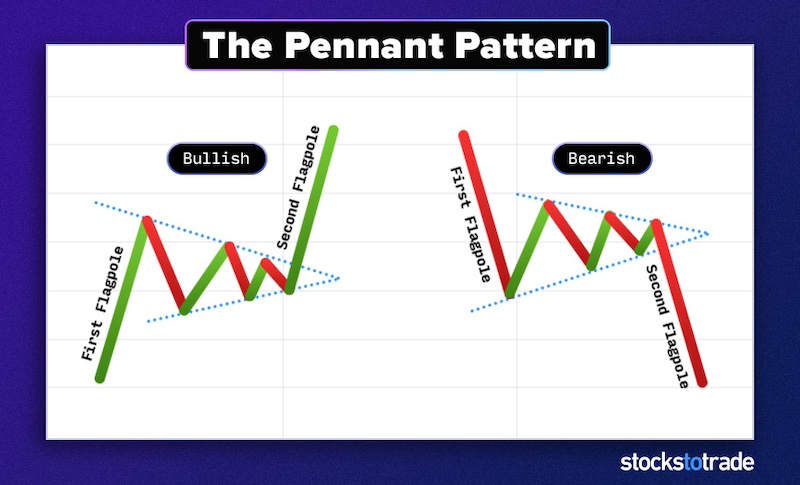

Bullish and bearish pennant patterns are two main types that signal different future movements in the stock market.

Bullish pennants form after a strong upward move, resembling an upward flagpole followed by a small symmetrical triangle, suggesting the potential for prices to continue rising.

The Pennant Pattern offers traders key insights into market psychology and potential future movements.

Bullish Pennant (Upward Flagpole)

The identification of an upward-pointing pennant could indicate a substantial positive motion impending.

This design becomes visible after a notable price leap, crafting an ascending flagpole followed by a stabilization phase that shapes a minor symmetrical triangle, mirroring a pennant.

Efficient identification and response to upward-pointing pennants enable traders to situate themselves favorably in anticipation of further price fluctuations.

Bearish Pennant (Downward Flagpole)

A bearish pennant forms after a potent price plunge, indicating the likelihood of the stock’s continued descent.

This pattern emerges when prices stabilize in a closely bound range creating a small symmetrical triangle, likened to a flag adorning a pole – hence, the colloquial “downward flagpole.”

Analyzing the Pennant Pattern on a Stock Chart

The pennant pattern signifies a period of consolidation following a significant price move, leading to a potential breakout in the stock market, and offering valuable insights for technical analysis.

This pattern, characterized by a triangular flag shape, indicates either short-term trend continuation or reversal, making it crucial for stock market traders.

Measuring the Flagpole

Analyzing the Pennant Pattern on a Stock Chart provides valuable insights into identifying potential trading opportunities.

Measuring the flagpole is an essential step in understanding and effectively trading the pennant pattern on stock charts.

- Calculate the length of the flagpole by measuring the distance from the start of the sharp price move to the beginning of the consolidation period.

- Use this measurement to project potential price targets for a breakout following the pennant pattern formation, offering valuable guidance for traders.

- Assessing the flagpole’s height provides a basis for setting realistic profit targets and assists in determining optimal entry and exit points for trades.

- Understanding how to measure and interpret the flagpole accurately is crucial in developing effective trading strategies based on pennant pattern formations.

Breakout Confirmation

To confirm a breakout in a pennant pattern, traders should look for the following indications:

- Volume Surge: A significant increase in trading volume during the breakout can confirm the validity of the price movement.

- Candlestick Formation: Look for candlestick patterns that support the breakout direction, such as bullish engulfing patterns for a bullish breakout or bearish engulfing patterns for a bearish breakout.

- Price Projection: Measure the flagpole’s length and project it from the breakout point to set potential price targets for the trade.

- Market Confirmation: Ensure that other technical indicators, such as moving averages or RSI, align with the breakout direction to strengthen confidence in the trade signal.

By considering these factors, traders can enhance their ability to identify valid breakouts and make more informed trading decisions based on pennant patterns.

How to Trade Stock Pennant Patterns

When trading stock pennant patterns, it’s crucial to analyze the breakout confirmation and manage risks effectively.

By measuring the flagpole and setting up protective orders, traders can minimize potential downsides.

Bullish Pennant

A bullish pennant pattern typically forms after a strong upward price movement. The price consolidates in a triangular shape before resuming the uptrend.

To trade a bullish pennant:

- Identify a strong uptrend followed by a period of consolidation.

- Wait for a breakout above the upper trendline of the pennant.

- Set a profit target by measuring the height of the flagpole (the initial uptrend) and projecting it from the breakout point.

- Manage risk with a stop-loss order below the pennant’s lower trendline.

Bearish Pennant

A bearish pennant forms after a strong downward price movement. The price consolidates in a triangular shape before resuming the downtrend.

To trade a bearish pennant:

- Identify a strong downtrend followed by a period of consolidation.

- Wait for a breakout below the lower trendline of the pennant.

- Set a profit target by measuring the height of the flagpole (the initial downtrend) and projecting it from the breakout point.

- Manage risk with a stop-loss order above the pennant’s upper trendline.

Remember: Pennant patterns are not foolproof, and false breakouts can occur. It’s essential to use these patterns in conjunction with other technical indicators and implement proper risk management.

Risk Management and Additional Tips When Trading Pennant Patterns

While pennant patterns offer potential trading opportunities, it’s crucial to approach them with a solid risk management strategy.

By understanding the inherent risks and implementing effective techniques, traders can increase their chances of success.

Position Sizing

When trading pennant patterns, determining the appropriate trade size is a critical aspect of risk management.

It involves calculating the capital to allocate, taking into account factors such as risk tolerance, portfolio size, and specific stock characteristics.

Stop-Loss Orders

Implementing stop-loss orders is crucial when trading pennant patterns. A stop-loss order is an instruction given to a broker to sell a security if it reaches a certain price, and it aims to limit potential losses in the event of an adverse price movement.

These orders serve as powerful tools for protecting profits and mitigating potential losses when executing trades based on pennant patterns.

Combining with Other Indicators

When considering trading with pennant patterns, combining them with other indicators can provide additional confirmation and insight into potential price movements.

Traders often look at other technical analysis tools such as moving averages, relative strength index (RSI), and volume indicators to affirm the signals provided by the pennant pattern.

False Breakouts

False breakouts occur when a stock seems to move beyond a key level of support or resistance, only to retract and close within that level.

This can lead traders to believe that a breakout is occurring, potentially causing them to enter trades prematurely based on misleading signals from technical indicators.

Overall Market Trend

Stock traders need to pay attention to the overall market trend when analyzing pennant patterns.

The direction of the broader market influences individual stock movements and can impact the success of a pennant pattern trade.

In technical analysis, understanding the prevailing market trend is crucial for making informed trading decisions.

Final Thoughts

Mastering the art of stock trading involves a thorough comprehension of different patterns. The pennant pattern, with its unique flag shape, provides traders with valuable insight into potential price movements in the market.

Whether it’s recognizing trend continuation or reversal, this pattern is a powerful tool for both novice and experienced traders.

By identifying and capitalizing on the pennant pattern, traders can discover new opportunities to optimize their gains in the ever-changing stock market environment.

Important: Please note that RoboticsAndAutomationNews.com is not a financial advice website and, therefore, the materials on this website do not constitute financial or other professional advice.

[ad_2]

Source link