Imagine you have thirty minutes with your chief financial officer (CFO) to present the business case for an automation technology. The investment will be in the millions of dollars. You have done your homework and have broad support within the organization. Your mindset is that you are not advocating for an IT project, you are advocating for business transformation that has IT components.

To create awareness prior to the meeting, you’ve given the CFO external benchmarks from peer companies and the McKinsey Digital report showing that automated processes are becoming the “primary drivers of productivity.”

Still, I can attest that it can be intimidating to be a presenter in those situations. Let’s face it, you do not have the same financial expertise as the CFO, but you must translate a technology investment into a specific financial outcome.

This article is the first in a three-part series that aims to help people advocating for an investment in automation within their organization. Part one (this article), will focus on how and when to engage the CFO.

How to engage the CFO

Step one in advocating for automation with your CFO is to know your audience. It is important to understand what lens your CFO looks through when making investment decisions. To understand this better, I recently spoke to UiPath CFO Ashim Gupta to gain his perspective.

In the video below, he talks about how the different backgrounds of CFOs will affect their decision criteria:

- Those that came from a controllership or accounting background will trend towards thinking about governance and risk associated with the program

- Those that came from the operations side of the company will think about how to drive efficiency into the broader business with the program

- Those that came up from the financial planning and analysis (FP&A) ranks will want to inspect the data used in the assumptions and pressure test the variables in the return on investment (ROI) model

Regardless of the CFO’s background, all CFOs are concerned about revenue growth, cost containment, and risk. When engaging the CFO, you would be well served to frame the automation investment in those terms.

When to engage the CFO

Automation is an enterprise-wide capability. Rarely will the CFO be the sole decision maker. Given the weight of these decisions, there is often a dozen or more people with significant influence on the investment.

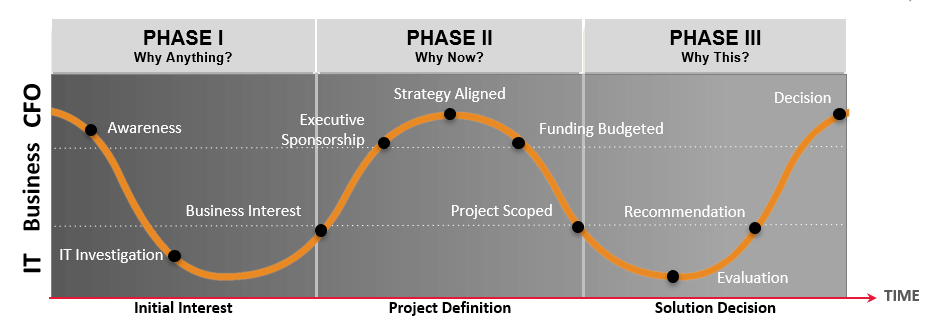

I have observed three phases that my customers typically go through when engaging with their CFO (shown in the diagram below). It starts with creating awareness and then orchestrating support for the program across many people in business and IT to gain consensus.

The CFO first makes a commitment to the program by including automation in the annual budgeting process. Later, after an evaluation led by business and IT stakeholders, the CFO or a buying committee makes the decision to release the investment funds.

Source: UiPath

Don’t underestimate the value that you personally bring to this automation journey by shepherding the process through each phase to get to a decision.

You are what I call a “mobilizer” because you have likely been chosen by a team of project enthusiasts for your ability to create a budget where one does not exist. As such, who better than you to fight for this project through each question that marks the three phases (explained in more detail below)?

- Why anything? The case for doing something different starts with the financial cost of not making a change. To prepare for discussing the benefits of automation with the CFO, try answering this question only in Microsoft Excel. Use a spreadsheet to tell the story of the “before vs. after automation” improvements via numbers. Explaining why the status quo is not good enough can also be anchored in customer and employee experience numbers that will show up in surveys and net promoter scores (NPS).

- Why now? As the diagram above points out, phase two is where you will have the most influence to impact the CFO’s decision. How well you argue that an automation program is urgent to consider now will enable you to secure executive sponsorship, ensure that the automation program is aligned to the broader strategy, and secure a line item in the budget.

- Why this? There is a high probability that there are other projects already in play that are competing for the same resources and making the same business case. A sure-fire way to lose CFO support is to have an opaque view of the future state after the investment into automation. The CFO wants a clear picture of the business outcome projected—typically expressed in revenue, cost, and/or risk—and why this should be prioritized over competing projects.

Aim for three horizons of value

A common trap in Robotic Process Automation (RPA) is thinking that a quick ROI can be calculated in a few select processes. This leads to a process-by-process funding approach in which every automation must justify ROI. I have seen this approach deteriorate quickly into a confusing assortment of disconnected projects with a broad array of stakeholders. Consequently, the RPA program stalls out, or worse yet, fails altogether.

How the RPA program is being funded will affect the pace of innovation.

I see successful mobilizers within companies set a “north star” vision of a digital assistant software robot for every employee from the beginning. Next, they provide a roadmap with milestones of value associated with this ambition so the CFO can decide to ‘go big’ and resource aggressively or work through each level of investment more conservatively.

I recommend explaining three horizons of innovation to the CFO by naming the stakeholders that will benefit from RPA. As you reach each stakeholder group and RPA delivers value at that level, the program can aim for the next horizon.

The most ambitious companies start in this order to compel the organization to ‘go big’ from the beginning with:

- Global process owners improving quality and compliance for complex processes that span across many departments, business units, and regions. This can start in one part of the end-to-end process, such as order management within order to cash. But it will quickly move upstream and downstream of the starting point.

- Shared services owners improving efficiency for throughput of high-volume transactions. This can include automating processes that were formerly in a business process outsourcing arrangement.

- Business unit leaders automating entire functions within their departments and increasing productivity of every employee with a digital assistant.

These ambitions are supported by an automation operating model that establishes a steering committee. The steering committee provides governance in protecting the CFO’s investment to ensure business leaders are achieving the ROI promised at each horizon.

Part two of this series will dive deeper into the three questions that will be on your CFO’s mind when you are presenting the value of automation: how soon will I get that value, how sure are we that we can achieve this value, and how much will it cost me. You will want to read it if you are looking for a sure-fire way to explain the full potential for automation within your organization and a tangible roadmap to achieve that potential.