And we’re back! Today was part two of Y Combinator’s absolutely massive Demo Day(s) event for its Summer 2020 class.

As we outlined yesterday, this is the first YC accelerator class to take place entirely online, from the day zero interviews all the way on through to their eventual demo day debut. We talked with YC President Geoff Ralston about what it was like to take the program fully remote (and whether or not it’ll be staying remote for the long run) in an ExtraCrunch interview here.

Nearly 100 companies presented yesterday, and almost 100 more took the stage today. Each company got 60 seconds to pitch an audience of investors, media, and fellow founders and tell the world — in many cases, for the very first time — what they were building.

Here are our notes on each of the companies that presented today:

CapWay: A mobile bank for the “financially underserved”. CapWay brings modern banking services to those in regions where only local (and potentially out-of-date) credit unions exist. The company makes money on the processing fee during debit card transactions. Set to launch in 3 weeks.

Supabase: An open source alternative to Google’s Firebase. Supabase helps developers by providing a Postgres database with a self-documenting API based around the data inside. 12 weeks post launch, the team says it’s already hosting over 1500 databases.

BaseDash: The people who know how to edit a database aren’t always the same people who need to do it. BaseDash lets non-engineers safely manage data as simply as they’d edit a spreadsheet, replacing custom internal tools.

Afriex: If you remember the early days of bitcoin and other cryptocurrencies, the idea that they would be huge for remittances was a regular talking point. Somehow that never took off quite as expected. At least not yet, if Afriex has its way. The startup uses USD-pegged stablecoins to help users to send money to other countries, and its model is catching on: Afriex is currently processing $500,000 per month, which is up 5x in the last three months. If Afriex can take on TransferWise and other services that have scale today, it would do well by itself and make cryptos look good at the same time.

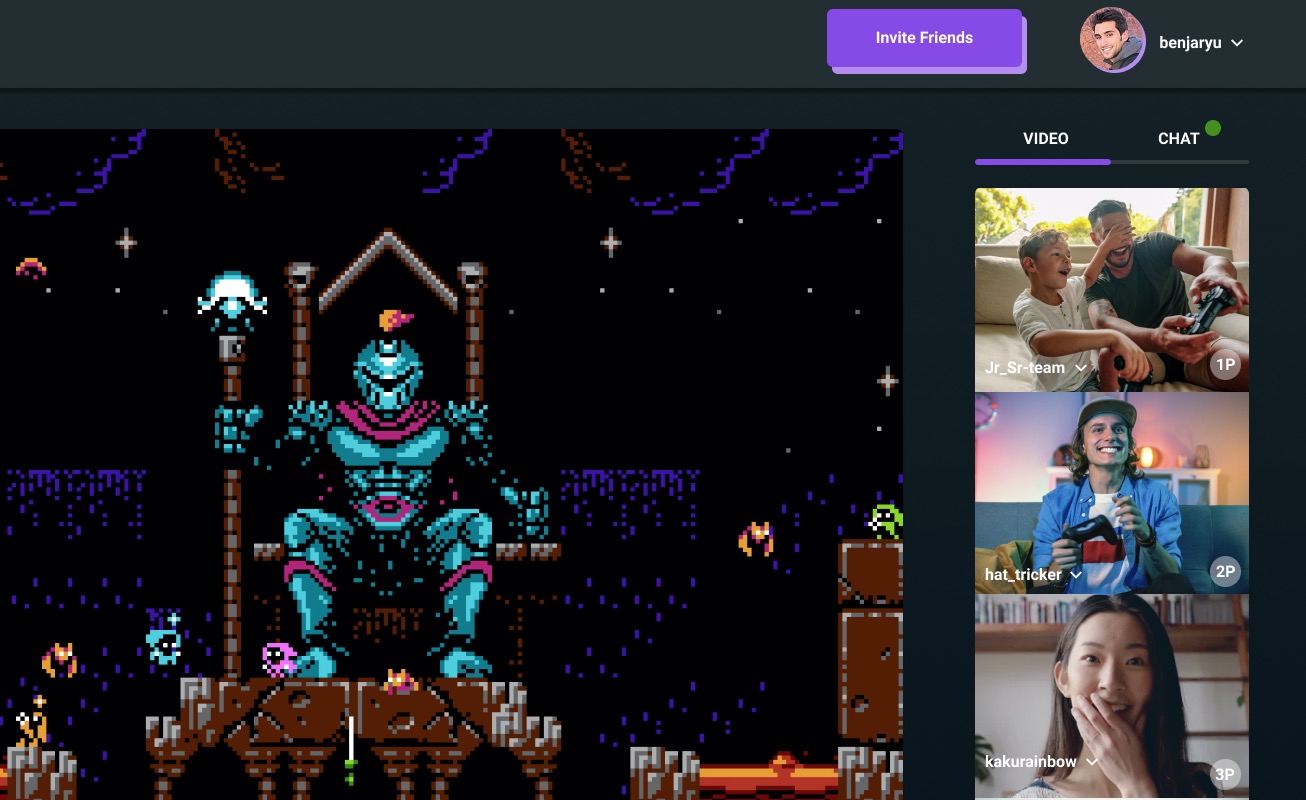

Image Credits: Backlot

Backlot: Meet the collaborative design tool for film and video industries that’s billing itself as the Figma for filmmakers. The company boasts that filmmakers can render their entire film in 3D, enabling productions to mitigate a lot of the risk and expenses associated with film production. Blockbusters typically hire teams of humans to do by hand what Backlot offers with its software. The company estimates that it’s an $11 billion market. Backlot charges $130 per user per month.

LSK Technologies: LSK is looking to tap computer vision to build disease testing hardware (a “lab in a box,” as they put it) small/fast enough to keep in a doctor’s office or workplace. The company says it’s currently running Zika Virus field trials in Latin America, and is looking at how they can bring their computer vision approach in to help tackle the COVID-19 pandemic. They also say they’ve seen over $100,000 in pre-orders to date.

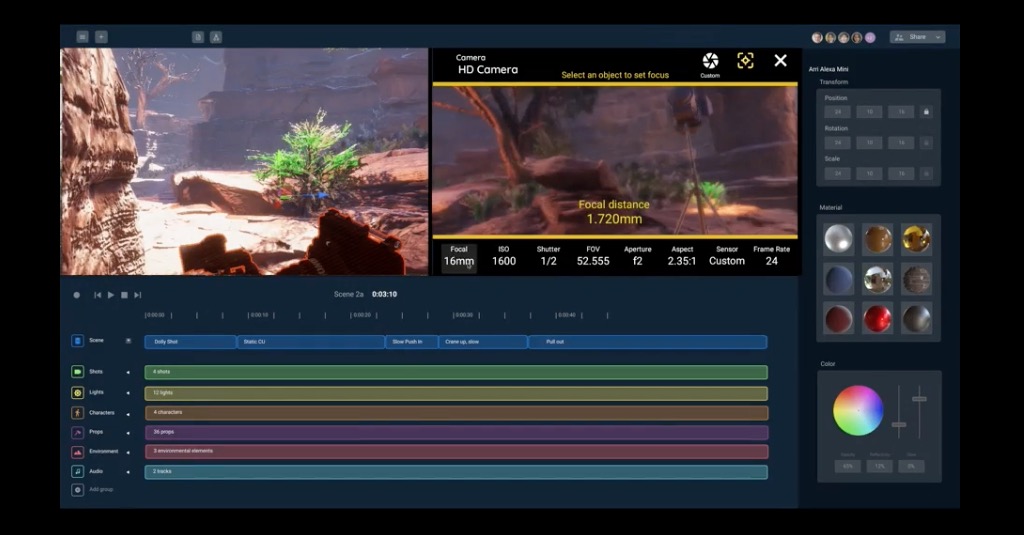

Image Credits: inFeedo

inFeedo: inFeedo’s “Amber” is an AI bot that chats with employees and aims to predict who is unhappy or about to leave. The team says it’s already working with 46 enterprise companies, and is cash flow positive with an ARR of $1.6M.

Opvia: Nobody is less satisfied with the data tools available to scientists than the scientists themselves, but they’re not often able to do anything about it. These two, however, decided to make “Airtable for scientists,” replacing the menagerie of tools old and new, from spreadsheets to MatLab, that researchers use to hold and corral data.

Porter: Remote development environments for microservices. Lets developers set up “templates” of the dev environments they use, and roll out new remote instances with a click. Currently used by companies like PostHog and Motion.

Plum Mail: It’s not an email and chat competitor, it’s an email and chat replacement. The startup sells a platform that focuses on communication features and scheduling tools. On its website, it says it has 36 “other era-defining features that blow e-mail and chat out of the water.” The startup launched 6 days ago and has 550 people on its waitlist.

Cradle: SMBs in India often resort to cash or checks because the overhead from online payment systems cuts into their profits. Fortunately new regulations make certain types of B2B payments free there, and Cradle is building a platform on top of these. With no interchange fees and all the usual benefits of instant online payment, this could help supercharge SMBs in this growing market.

Clover: Creatives are still largely stuck living in Google Docs and Word, two pieces of technology that are designed around the history of physical paper and printers and general Office Space sadness. Clover wants to shake the text doc world for creatives on an “infinite canvas.” The company’s product isn’t launched yet, so there are no growth numbers to share, but the startup does claim 5,400 folks on its waitlist. Our question is how you get creatives to pay for stuff, as most creatives that we know are out of work. Regardless, down with today’s terrible text apps! Let’s see if Clover can shake its market up.

Datafold: automates quality assurance of analytical data. Anytime a developer makes a change, Datafold analyzes and verifies the output across your databases. Developers spend hours checking data manually, but incidents happen because there’s not a good way to handle all of the changes that go into modern software programming.

Depict.ai: Joining the host of products aiming to help SMBs compete with Amazon in the ecommerce sphere, Depict.ai is building a product recommendation engine to help bring “Amazon-quality” product recommendation for any e-commerce store. Customers include office bigbox chain Staples.

DigitalBrain: Pitched as “Superhuman for customer support agents”, DigitalBrain says it can help CS reps get through tickets twice as fast. Currently in 10 paid pilots after launching 6 weeks ago.

Image Credits: Daybreak

Daybreak Health: Online counseling for teenagers. The startup uses a mobile app to connect teens to teen-specialized therapists. It also communicates with parents to figure out a plan for online counseling. Founded by Stanford alums, Daybreak Health is bringing in $6,000 in monthly revenue and claims it is more affordable than private practice. Read more in our story here.

Phonic: Surveys are useful for a million reasons, but the text-based online surveys we’re all familiar with haven’t changed much in 20 years, leaving them open to manipulation and fraud. Phonic avoids this by using audio and video responses rather than text or buttons, and the company says this triples response quality and helps eliminate fraud and joke responses. The media are automatically ingested and summarized using machine learning, so no, you don’t have to watch/listen to them all.

Dapi: Dapi is a fintech API play that is aimed at facilitating payments between consumer bank accounts and companies. That Dapi has managed to make its service work in seven countries with deep bank support is impressive. And Dapi has found demand for its service, with $400,000 in ARR and growth of more than 50% per month as of its presentation. Of course, that growth rate will sharply decline in time, but everyone knows that fintech APIs can have big exits. Expect to hear more from Dapi.

Reploy: By rolling out staging environments with each code deploy, Reploy lets developers share features with their teams and get immediate feedback. Reploy has $1500 in monthly revenue after launching roughly 3 weeks ago.

Index: Index wants companies to use its no-code dashboard builder to help visualize their KPIs and track performance. The tool boasts integration with a variety of data providers so that users aren’t forced to manually enter data into another tool. The startup hopes that building embeddable dashboards will help their solution catch fire and that startups will turn to their tool when they want to track progress on goals.

Ramani: Helps distributors in Africa manage their inventory, allowing sales people to catalog and track sales. Currently running 5 pilots, they’ve seen $80k worth of sales logged to date.

Spenmo: Framing itself as Bill.com for SMBs in Southeast Asia, Spenmo helps companies manage their payments. The founding team hails from Grab, Xendit, and Uangteman. After launching 5 months ago, it has 150 companies as customers and processed $500,000 in transactions in July.

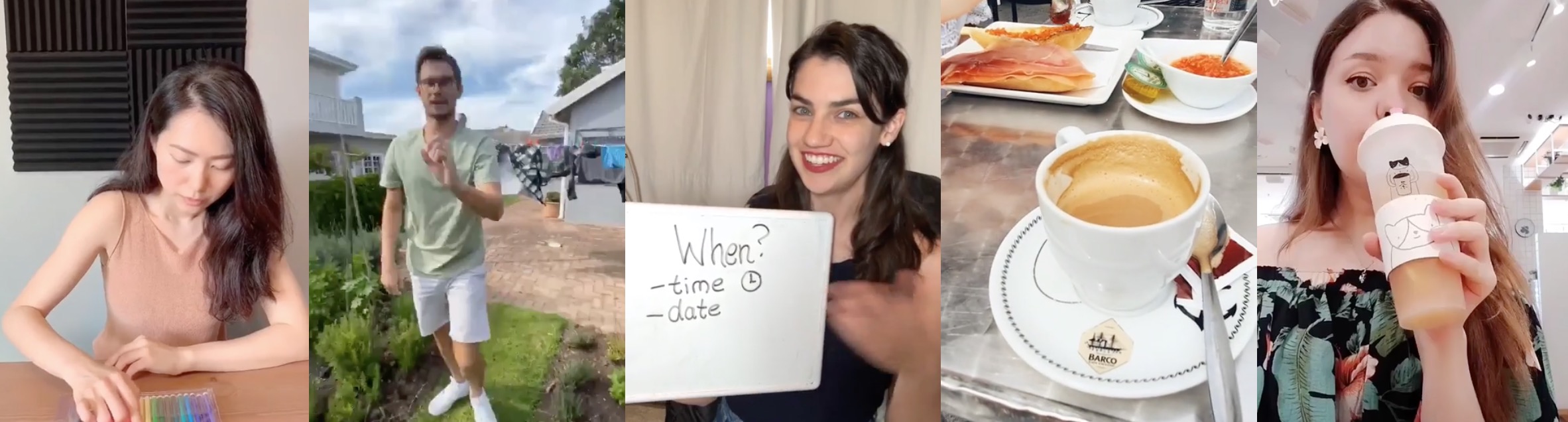

Piepacker: We can play games together, and we can video chat, but it’s not actually that easy to play games together and video chat. Piepacker combines video with a collection of licensed popular retro-style games that friends can play together easily. It’s simpler than putting together a Discord group but more interactive than just streaming. So far the platform has seen long sessions and engagement.

Farel: Another Shopify for X startup, Farel stood out from the pack by having an idea that we’d never thought of: Shopify for regional airlines. The Farel team says that regional airlines — those with fewer than 30 airplanes — make up 30% of the $600 billion air travel market; Farel wants to offer better software for those airlines, charging $1 per traveller per segment. That sounds super cheap? So far the startup is lining up early customers and partners, so it’s a bit too early to say if Farel will, ahem, take flight.

PhotoRoom: This promising startup already has over $1 million in annual recurring revenue, thanks to its service that removes backgrounds from product photos. It’s grown 50 percent since its launch in February and the simple service belies some pretty interesting technical wizardry with machine learning tools to effortlessly retouch marketing images.

Liyfe: Liyfe is building a telemedicine platform for breast cancer patients to communicate with oncologists and cancer professionals from home. The founders hope that more communication between experts and cancer patients can lead to more thoughtful approaches and outcomes.

Openbase: Reviews and insights to help developers choose the right open-source packages. Founder Lior Grossman previously founded Wikiwand and the open-source project Darkness. According to Grossman, Openbase is already seeing 250,000 developers per month.

Image Credits: Quell

Quell: Quell is eyeing what they see as a $18 billion market opportunity in the immersive fitness gaming market. The startup uses resistance bands to help players get fit while fighting their way through a virtual fitness world. It coins itself as a “Peloton meets gaming”, and charges a monthly fee to keep content fresh.

Hypotenuse: E-commerce sites need a lot of copy: product descriptions, ads, blog posts and more. This is generally done by copywriters, but the quality (especially if hired from by-the-word content farms) can be hit and miss. Hypotenuse generates high quality copy automatically for a variety of purposes and they claim switching to their system boosts engagement by double digits. The founder has a strong AI background so you can at least count on the science.

Reflect: Testing your website or web service is time-consuming and hard to get right. And if Reflect is correct, the existing tooling in the market to help make web testing better is too complicated for most folks to use. Reflect is a bet that a no-code (buzzword!) tool to automate web testing (desktop and mobile, per its website) will be a hit. The company claims $9,600 in MRR, growing at 30% month-over-month.

Byte: Byte is building on-demand food delivery from virtual kitchens in Pakistan. Using virtual kitchens, Byte can slash the cost of food prep, the company says. Byte is already growing 40 percent week over week. The company makes $1 per order, and says it has a total addressable market in Pakistan of $20 billion to make food delivery cheaper.

Parrot Software: Parrot is building Toast for Latin America, creating a suite of back office tools for restaurants. The software handles all of the expected tasks, including customer payments, ordering, seating and data visualization.

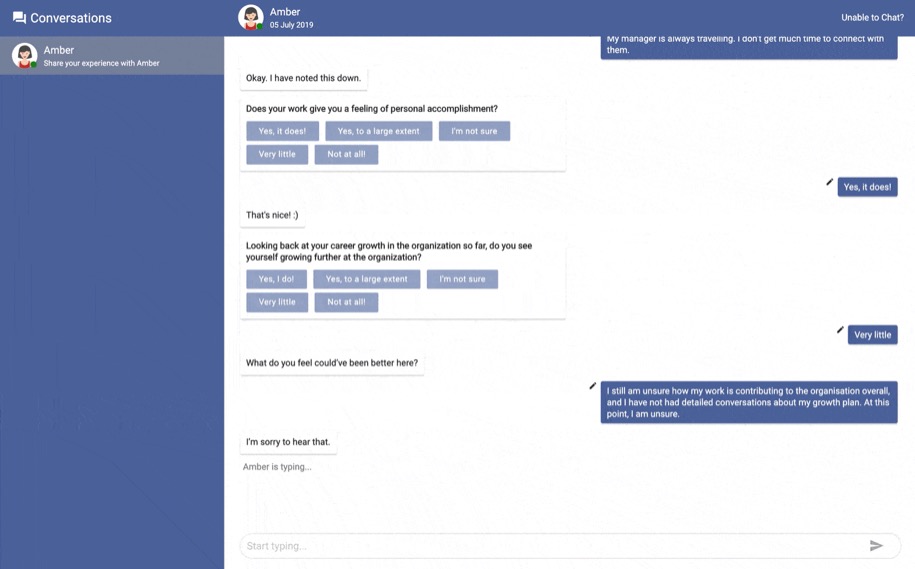

Image Credits: BlaBla

BlaBla EdTech: An app that aims to help the user learn English using short, TikTok-style videos. Founder Angelo Huang says the company has 8,000 weekly active users six weeks after launch.

StratumAI: Artificial intelligence software and technology that helps mining companies figure out where to mine. Stratum charges $2 million per year, per mine and it helps those customers unlock an average of $10 million in profit during the same time period.

Intelline: Diesel generators may sound like 20th century tech, but they’re used everywhere, both by industry and individuals. Intelline has designed a diesel generator that they claim has 40 percent better fuel efficiency, which translates to enormous savings at scale; Mining operations, they note, could save millions per year with better diesel generators.

Ilk: Using a thesis of the “childcare pod”, Ilk is coming to the rescue of worried parents who need to find better/safer childcare solutions during the COVID-19 pandemic, according to the company’s founder. With a childcare pod, two to five families team up to pool resources and pay for a caregiver to care for their kids. The company’s service matches parents with caregivers. The very very early stage company has already set up two successful pods in San Francisco and officially launches next week.

Isibit: A platform for managing/overseeing business travel, focusing on companies in Latin America. Allows travel managers to configure travel policies/limits, and offers employees rewards for making affordable travel choices. The team says they’ve seen over $10,000 in bookings a month after launch.

QuestDB: Born years earlier as a side hustle being built on nights and weekends, QuestDB is building an open source time series database focused on speed. If the startup pulls it off, it can help companies detect fraud plus plan and predict customer activity at a faster speed than other competitors. The company is currently being tested at a fintech unicorn, and several companies are using it as part of their production processes. Read more on our coverage here.

WareIQ: Companies in India are trying to wean themselves off Amazon’s infrastructure, but can’t match the company’s fast shipping. WareIQ is a software platform that links India’s huge network of fulfilment centers and last mile couriers to enable next-day delivery for budding e-commerce sites that would normally only be able to offer 5-15 day shipping.

Kernal Bio: MRNA therapies to cure COVID and Cancer are a pretty compelling business proposition. Kernal Bio says it has developed therapies which rely on using messenger RNA to instruct cells in the body on how to make their own defenses to diseases. The team has an incredible background with co-founders that include a former researcher from Merck who’s developed therapies already. A former founder of Santigen and a phD scientist from MIT. The company has already won three awards from Amgen and NASA.

Kosmos: Kosmos is building a control center for a company’s microservices, helping developers monitor and debug a web of services inside a unified interface. The company is integrating all of these tools so developers can see updates and track changes without being forced to search in multiple locations.

Matter: Pitched as “Superhuman for reading”, Matter says it is building an “opinionated reading app” to help users find better content online. Currently in private beta on iOS.

Ladder: Building a labor marketplace to help construction companies hire skilled workers for permanent positions. Essentially, Ladder works as an HR team that construction companies can turn to for hiring and retention needs. It has 1,340 workers on the platform and booked $12,200 in revenue in the first month of launch.

Letter: Letter is a bank specifically for rich people, made by a newly rich person who didn’t like existing banks. Aimed at “high net worth individuals” with $1-10M in assets, Letter includes features specifically for the wealthy, replacing the pedestrian tools and designs of ordinary banks and credit unions. The team says they earn up to 2% per transaction.

Maytana: Pitching itself as the financial payment center for multinational startups, Maytana makes it easier for multinational businesses to move money using open banking APIs. The company has three customers and is charging a 0.01% fee for money transfers. There’s $10 trillion being transferred around the world and Maytana thinks it can capture a big chunk of that spending.

Safepay: Safepay wants to build a Stripe for Pakistan, crafting a digital payments API in the country where the founders say there are no other major players in this space.

Jumpstart: Helps international founders setup businesses in the US, aiding with things like incorporation and establishing bank accounts. Charging $129-$329 per year, the team says they have 1,280 companies on the service today.

Mozper: A debit card and app for kids and parents in Latin America. The startup is seeking to tailor to the smartphone-carrying youth, sticking with them until adulthood and becoming their de-facto bank option along the way. Mozper’s core product is a debit card, which it charges a fee for, and an app. The startup has already raised $1.5 million from investors and friends. Read more with our previous coverage here.

Parade: Parade lets online brands generate tailored marketing content automatically. You fill out a survey about preferred styles and other info, and it generates assets, including social media posts and a style guide for other content — all with no human in the loop. It’s a big industry dominated by expensive human designers, and Parade feels there’s plenty of room for an automated solution like theirs for businesses that can’t afford or don’t want to deal with the human element.

Nestybox: creating software to enable containers to replace linux virtual machines. Instead of deploying a few heavy VMs on a server, Nestybox lets you deploy a number of containers for the same functionality. There are 30 million deployments which represents a $6 billion opportunity for Nestybox. Containers have already revolutionized programming, now Nestybox is looking to extend that revolution to compute infrastructure.

Here: Here is building “personal, shareable, flexible” in-browser video chat rooms. Unlike most other video chat startups, the company’s founder says they’ve built their own video stack. Seeing their website, it definitely has its own unique look, bringing in some 90s website design paradigms with modern video chat.

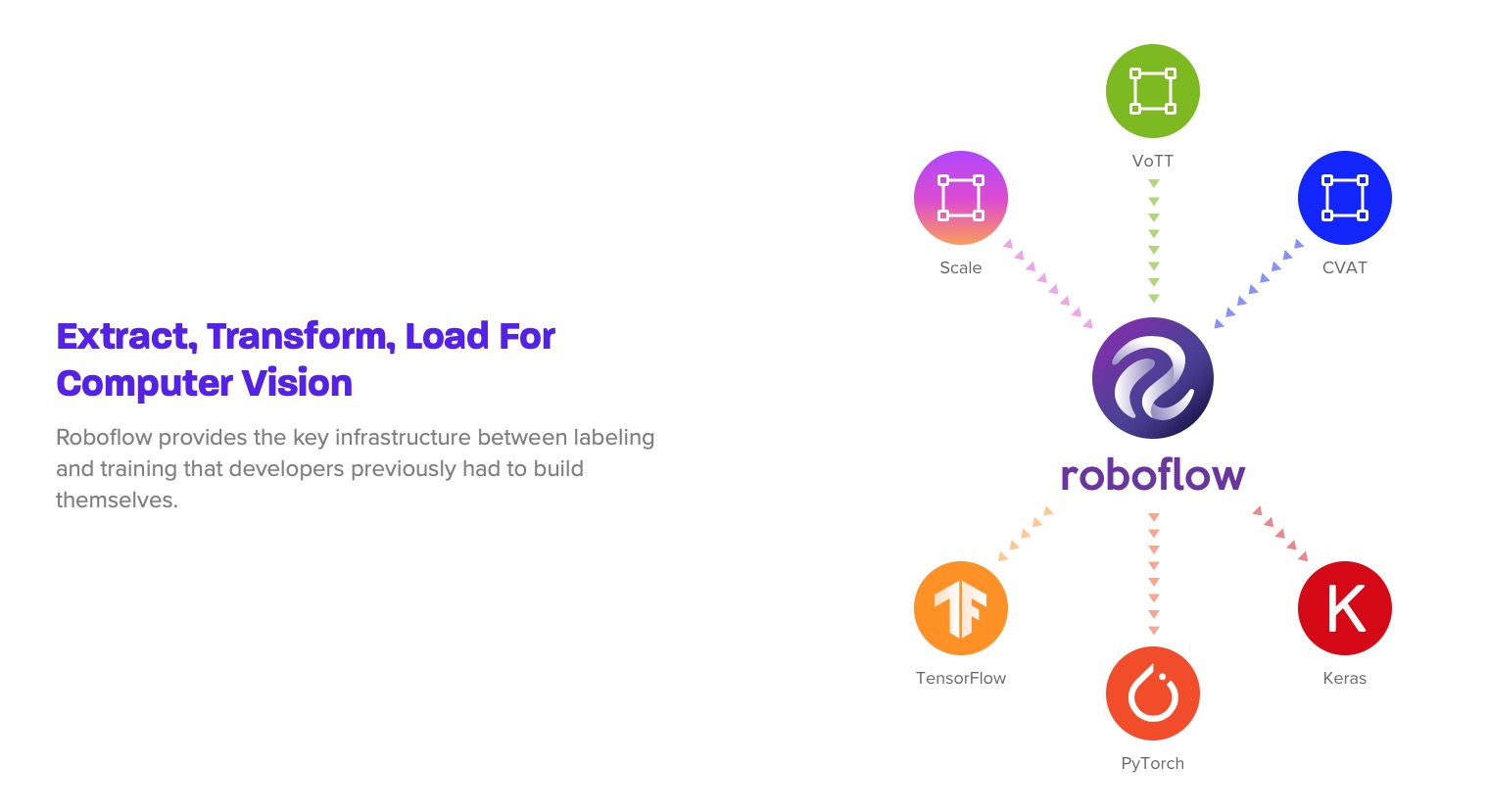

Image Credits: Roboflow

Roboflow: Helps developers build computer vision models without having to know much about machine learning. Co-founders previously built AR-heavy Sudoku solver Magic Sudoku, spinning the tools and learnings they put together there into Roboflow. The team says there are currently over 1,000 developers using Roboflow each week.

Vena Vitals: Sells a wearable sticker that allows consumers to monitor their blood pressure continuously. It’s a replacement for needles, at a fraction of the cost and clinical accuracy. The company is starting out the clinical route, but wants to become the standard for blood monitoring and managing for consumers and hospitals over time.

SafeBase: B2B SaaS companies, of which there are approximately five million in this batch alone, need to be able to show that they meet security standards in a clear, verified way or they risk losing customers. SafeBase aims to be a one-stop status page that provides “instant credibility” by showing compliance with security standards.

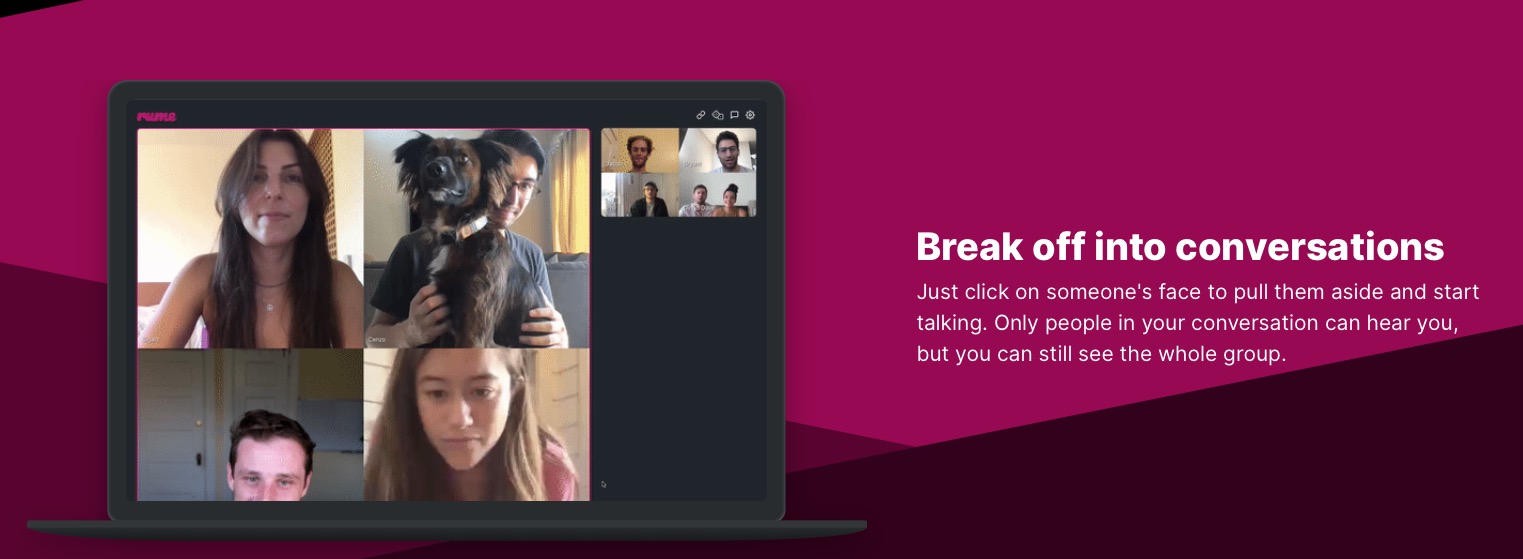

Image Credits: Rume

Rume: Rume wants to make the social video experience better by allowing groups to have multiple conversations in one space. The company says it enables attendees to fluidly move between groups just like they would at a party. So far, the average Rume session is 50 minutes long and the company has integrated games into the Rume. What sets Rume apart, the company says, is that it owns the entire video stack, thanks to the expertise of the co-founders as former developers at Google and Dropbox.

Oico: Oico is a B2B marketplace for construction materials in Brazil. The company is aiming to build the “missing infrastructure” to help large contractors acquire materials, pointing them to materials providers and facilitating deals. The company takes a 10% slice of transactions, and they’ve reached $87k GMV after four months on the market.

Osmind: Millions of Americans suffer with mental disorders that traditional psychiatric and psychological treatments don’t address. While experimental treatments have been developed, they’re not being delivered or tracked effectively, thanks to the barriers that exist in practice management, reimbursement, data collection and distribution to pharmaceutical and insurance companies. Osmind wants to use its practice management and monitoring software to help mental health professionals deliver care to this population that’s most in need… and provides anonymized insights for pharma/insurance companies to ensure that these treatments are effective. Find our previous coverage of Osmind here.

Todos Comemos: A ready-to-cook meal kit delivery service for Latin America. The company sources food from production facilities that serve restaurants and hotels and is able to turn over meal kits at a cheaper price, with a 30% margin after delivery costs are accounted for.

Orchata: Grocery stores and other food suppliers in Latin America rely on outdated methods like paper/pen for things like ordering and delivery, if they offer it at all. Orchata wants to be the Shopify for online grocery ordering in the region, enabling these small businesses to list items and receive orders online, accept payments, optimize delivery routes, and so on. The company says 1.7M people can be served at their current pricing, which suggests it’s a bit expensive for most, but really, that’s true of Instacart and others as well.

Speedscale: Another programming dev tool to make life easier, Speedscale simulates APIs using actual traffic. Founded by former leaders of engineering and developer solutions at companies like NewRelic, Speedscale solves the problems of code oversight that even companies built with state of the art cloud services have to face. Development updates are often impossible to test due to too many dependencies, but Speedscale says it validates each component with real traffic. The company already has Digibee as a customer and hopes to roll up each of the 11 million developers programming with APIS, which would represent a $6.5 billion market opportunity.

Stacker: Stacker is another startup aiming to upscale the spreadsheet with no-code functionality, allowing the company’s users to turn spreadsheets into internal apps and customer portals. The software pushes customers to let data drive designs and turn manual processes into automated ones. The company has more than 250 customers including Google and Amazon.

Epihub: Another Shopify for X! This time it’s “Shopify for anyone teaching online”. Epihub is a platform meant to help online instructors schedule/run classes and charge students. 3 weeks after launch they have 50 paid instructors on the platform, with an MRR of $1k.

Notabene: Helps businesses perform crypto transactions in a regulatory compliant way. The startup wants to be the “trusted layer on top of blockchain” for sharing information. The market is looking to cash in on the new global regulations on crypto that is driving adoption but, at the same time, confusion. In 3 weeks, it landed 10 signed customers.

Bits: Bits helps people build their credit score by providing them with a digital credit card that they pay off every month. Sure, you could do it yourself, but why not have a service that helps you out? In nine months the company has attracted 10,000 paying customers and collected $1.9M in revenue, and some customers have seen their credit scores jump by hundreds, so clearly there’s something to it. The founder hopes that this straightforward beginning will be the basis for a new, more full-service billion-dollar fintech company.

Oco Meals: Delivering prepared meals made by local catering companies has already nabbed Oco Meals 25,000 in monthly recurring revenue. Unlike most delivery businesses, Oco Meals delivers pre-ordered food in bulk once a week. The company boasts that it’s able to give customers better pricing at half the cost and still make $25 per order.

Response: Response is another YC startup that’s focused on the response to COVID-19. The startup is building a network for PPE in the United States allowing suppliers to bid on customer requests. The startup hopes that they can further scale this infrastructure beyond PPE in the future and eventually become Alibaba for the United States.

RingMD: Helps governments quickly roll out telemedicine in their countries. Currently working with customers in Chile, the Philippines, and India while charging $3 per user per year, founder Justin Fulcher pins their ARR at $632,000.

CarbonChain: A way for companies to automate the arduous process of tracking their carbon emissions. The company, which is profitable, has landed 5 paying customers with $280,000 in annual recurring revenue. CarbonChain’s success hinges on more than just the benevolence of business leaders. It’s betting on government regulation as a catalyst for companies to care (and transform) their carbon emissions. Read our coverage here.

Panadata: Background checks are an ordinary part of doing business everywhere in the world, but the data is fragmented across multiple government databases and other document hoards. Companies have emerged to sift through the mess in the U.S. and E.U., but Latin America provides a unique challenge and Panadata hopes to tackle it. Its automated check system is already in action and in use by banks, law firms… even the local governments in charge of the data it uses.

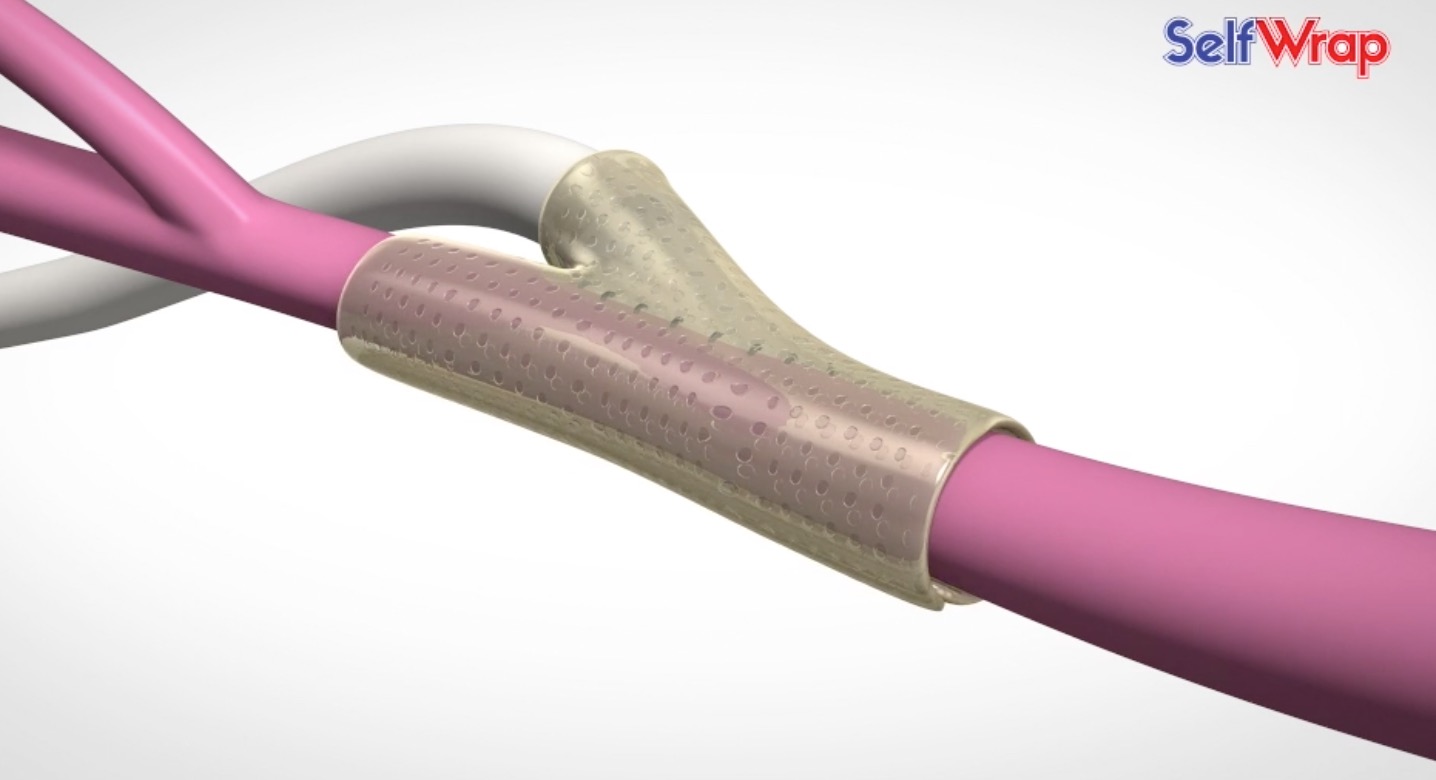

Image Credits: Venostent

Venostent: Venostent, the company that’s developing a novel material for stents and vascular reconstruction and stenting surgeries, has already won prestigious prizes from HHS and the NIH and will be beginning a clinical trial this year. The company has a $5 billion market opportunity ahead of it in just its initial market alone and it has 92% gross margins. Read more about our coverage on this company here.

NeXtera Workforce: NeXtera is building a software platform to help factories integrate robotics into their processes in days instead of months. The AI platform is focused on deployment, monitoring and tech support to help optimize rollouts. Early customers of theirs include Dunkin Donuts and Tesla. The founders are MIT alumni with backgrounds in AI and cybersecurity.

Finch: An API to help developers tap into payroll systems (like ADP, Gusto, Rippling, etc) “with three lines of code”, enabling them to do things like verify income, set things up for direct deposits, pull paystubs, and confirm employment.

Scrimba: An online, personalized coding school coming out of Oslo, Norway. Scrimba teaches students coding through interactive videos that are pre-recorded. Students are able to actively code throughout the videos, and so far Scrimba has worked with students from over 100 companies.

Tangobuilder: Taking an architect’s designs from concept to construction-ready blueprints is an expensive, complex job done by structural engineers and other experts. Tangobuilder automates the process, saving time and money — for example, they claim one hospital project was 2 months faster and $1.5M cheaper because it used their platform. You can read our coverage of Tangobuilder here.

Frontline: How about a startup that gives developers — no matter their security experience — NPCI compliance? That’s Frontline. The company already has $22,000 in monthly recurring revenue and is growing 42% monthly. Already 20 Fortune 500 companies are using the company’s service. Typically the process to deploy a secure virtual machine takes 100 hours to complete. Frontline’s service is an obvious and affordable choice to get that chore off of developer’s plates. The company estimates that its service represents a $4 billion market.

Synth: Synth is building a platform for creating compliant, realistic fake data for application development, cloning existing databases while synthesizing the specifics. The startup believes its approach will help promote better data privacy and compliance with regulations while still maintaining accuracy.

Sutra: Looking to help the countless fitness instructors put out of work by COVID gym closures, Sutra charges $25 per month with a 3% transaction fee to help instructors host live fitness classes and sell videos/monthly memberships. Their platform can be integrated into your existing website, or they can provide a landing page.

Trident Bioscience: Sells software that helps biotech companies design proteins with recent breakthroughs in mind. The company has predictive models that help customers decide which kinds of proteins should be made. The founder, Tyler Shimko, has a PhD in genetics from Stanford. Trident is currently working with 2 biotech companies.

TyltGo: Brick and mortar stores and small online retailers want to provide same-day delivery, but would prefer not to own a bunch of trucks. TyltGo provides same day delivery service on demand, batching orders from multiple retailers to optimize routes, lower costs, and reduce the need for warehouse space.

Tappity: The company bills itself as the interactive Netflix for kids. It already has 5,000 subscribers and $55,000 in monthly revenue. It’s picking up 20,000 free downloads per month and has no marketing spend — something that’s a valid selling point given the high costs of consumer customer acquisition. Customers pay $8 for the service and with 25 million kids in its target market that’s a $2.5 billion market opportunity. It’s already the number one science app for kids on the app store and the company plans to add classes for programming, history math and art. The goal, the company says, is to build a veritable Library of Alexandria of interactive lessons that kids are curious about.

Ukama: Ukama is building technologies to allow any enterprise to create their own LTE-based cellular network. The founder says that this approach can reduce network bills, increase security and provide more accessibility to on-campus users. The CEO previously founded another cellular network startup that was acquired by Facebook.

Biocogniv: Builds AI-powered software to help hospitals diagnosis patients, analyzing their EHR (electronic health records) in real time. Currently focusing on predicting COVID outcome, they will soon expand to screening for signs of sepsis and pulmonary embolisms.

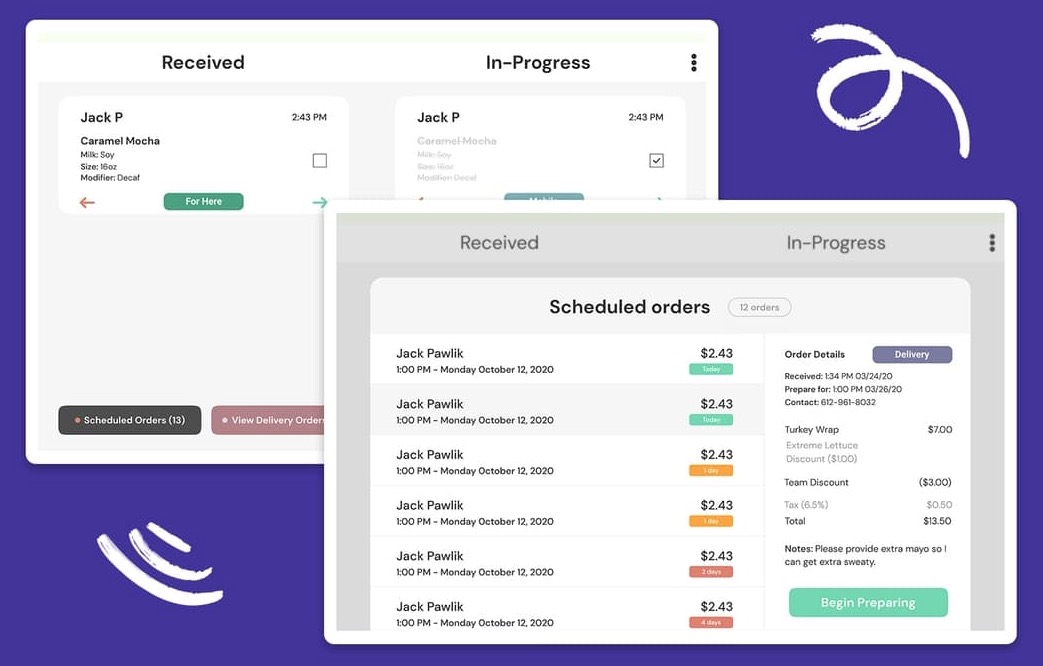

Image Credits: Drip

Drip: Rather than a restaurant running on a collection of disconnected pieces, Drip provides what it claims is “the only piece of software a restaurant needs to run its entire business.” That means POS, employee scheduling, payroll and more. With lots of restaurants modernizing their methods during the pandemic, Drip has grown from doing $10k/month in business in June $600K in August.

Henry: Bringing the income sharing model to Latin America to help potential students pay for their education, Henry is a company that thinks it’s in the right region at the right time. It already has more than 500 students and it’s serving an incredible need given the flood of demand coming from tech companies in the region. The college and university system is broken, Henry argues, and it’s got the education opportunity for new developers. “That’s why we created Henry. To unlock potential and bring high quality education with an income share model.”

Batch: Batch is building a Time Machine for corporate data. The startup’s tools allow customers to observe and replay data inside messaging systems to help them quickly diagnose outages and data disasters and revert changes.

Cohere: Superhuman onboards users with a live, one-on-one training session with a live guide; Cohere wants to open up that same concept to any other application with just a few lines of code.

Verifiable: With healthcare increasingly moving online, it’s more important than ever to keep things up to date and verified. Verifiable is building an API to automate license verification for healthcare providers, integrating with state and federal sources. After launching this month, the company says it’s projecting an ARR of $210k.

Virtually: An all-in-one solution for anyone looking to build an online school, providing tools for admissions/student management, video conferencing, payment processing, and a forum to keep in touch with students. Virtually says it’s currently working with over 25 programs just 3 months after launch, and will charge $10 per student per month. The startup is selling a white-label solution that organizes the mess of tools that teachers or schools currently have to piecemeal together.

Fieldguide: Fieldguide is building a software suite for accounting firms, helping them rethink how they conduct audits, generally allowing for greater collaboration inside firms. The platform blends secure data requests, controls testing and automated reporting. The company launched in July and has $150K in signed commitments.

Acho: A point-and-click, no-code interface for processing and publishing data, Acho helps users dig into their data without having to write complicated SQL. With 300 users onboarded in the month after launch, the team says they’ve processed over 100 TB of data already.

SuperTokens: Maintaining a user’s session at a frequently visited site removes the need to log in again, but also presents security vulnerabilities — in fact session attacks are one of the sneakiest new attack vectors out there, and big companies aren’t immune. SuperTokens helps securely manage sessions while providing state of the art defenses against the latest attacks and enabling easier compliance with security standards. Their libraries are already seeing lots of use by industry majors and a paid version is gaining traction.

Finmark: Doing for financial management what Carta did for equity and fundraising, Finmark is financial planning software for startups to manage runway and cash. Trying to manage your business off an excel sheet is painful, but for startups proper oversight this can mean the difference between thriving and dying. 300 companies have signed up for its financial management service, the company says.

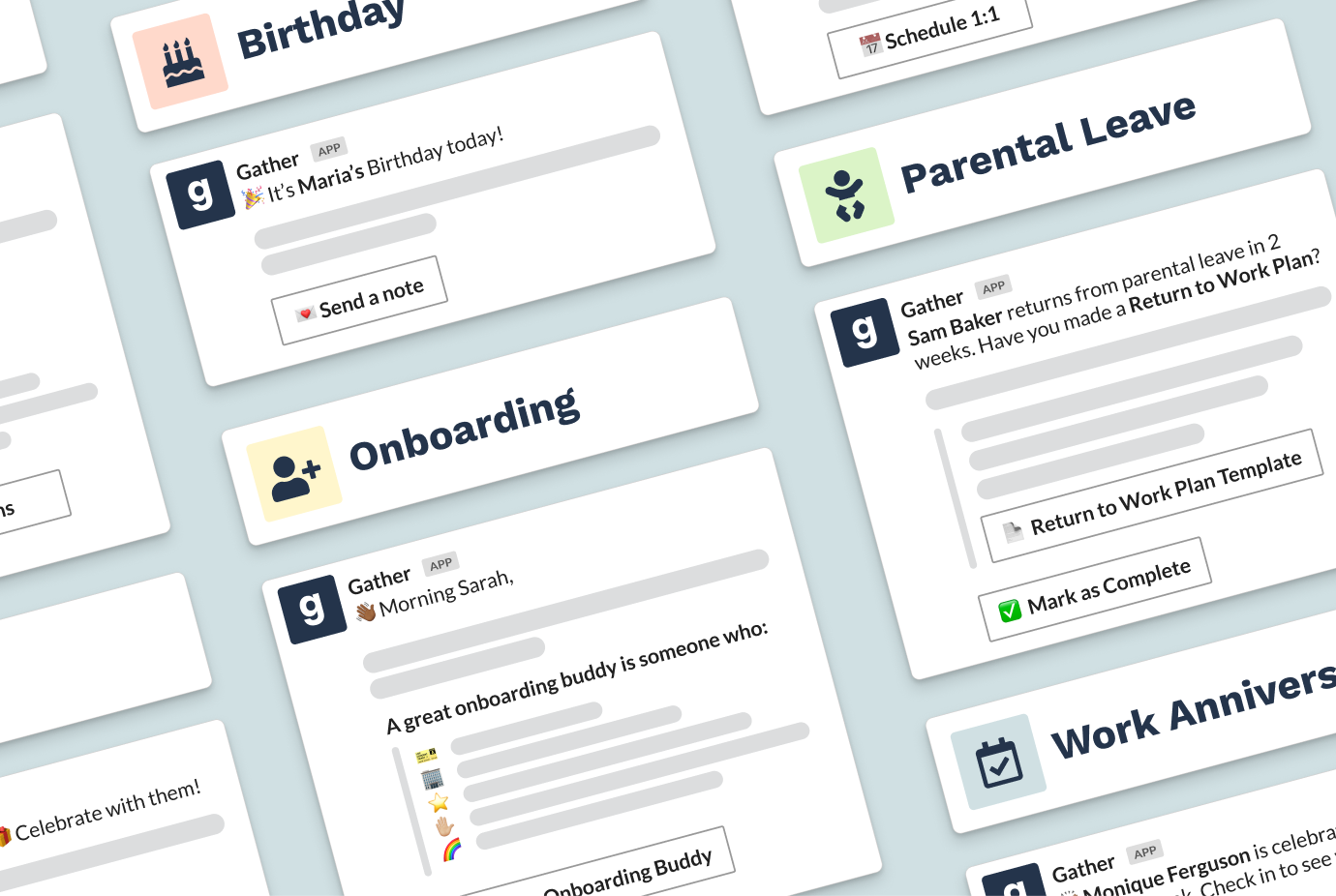

Image Credits: Gather

Gather: Helps people ops team coordinate things like onboarding/offboarding/temporary leave through automated Slack workflows. Co-founder Alex Hilleary says they’ve found 10 paying customers after opening the gates just two months ago, and have onboarded one unnamed 700-person company. Find our previous coverage of Gather here.

Yottasavings: The upstart American challenger bank, Yottasavings has accumulated over $30 million in deposits since its launch in July. The company was inspired by premium bonds; the idea is that it encourages savers to deposit money into their accounts by giving them the ability to win prizes. In the UK, the government-run savings program has attracted $100 billion in savings from one third of the population. The team notes that the overall concept was illegal in the US until 2015 and it requires a fundamentally different approach to building a banking product. The company boasts that it could be the next big challenger bank in the US, by borrowing this UK model and with the amount of savings it has collected, seems to be on its way.

[ad_2]

Source link