Amazon has been dabbling in the cargo market for several years, having initially operated as Amazon Prime Air from 2015. In 2017, it changed its name to Amazon Air to differentiate itself from its drone delivery service. However, even then, it continued to rely on wet-leased air cargo capacity and did not own its own aircraft.

In December 2018, Amazon Air committed to the lease of an additional 10 Boeing 767 freighters from Air Transport Services Group (ATSG), taking its total fleet to 50 airplanes. All were being operated by either ATSG or Atlas Air, as Amazon does not have an Air Operators Certificate (AOC) or any crew of its own.

Come mid-2020 and Amazon began adding smaller airplanes to its cargo fleet. It took up a swathe of Boeing 737-800Fs, operated by Sun Country Airlines, and today has a fleet of 26. It has taken its total of 767s to 55, and has inducted Cargojet Airways and ASL Airlines Ireland to its operator pool. It also bought its first aircraft, four from WestJet and seven from Delta, in January last year.

Amazon Air bought its first owned aircraft last year. Photo: Amazon

Most excitingly, the airline signed with Silver Airways to operate turboprop cargo flights using the ATR72-500. The first to arrive came in September 2020, when a 2009 vintage ATR was spotted with Amazon Air livery, a former Aurigny aircraft. Four have so far joined the fleet, with another earmarked for delivery soon.

Growing faster than the leading cargo airlines

While Amazon Air is sticking to its plan of wet leasing capacity, the distribution giant is looking more like an airline with every day that passes. It has firmly taken advantage of the uptick in demand for eCommerce during COVID, and has grown significantly in the past 12 months alone.

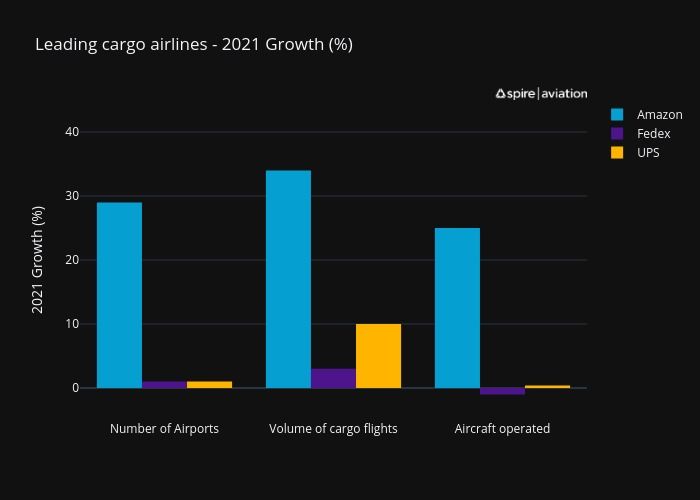

Compared with leading cargo airlines FedEx and UPS, Amazon Air has exhibited ridiculously strong growth, while theirs have been somewhat stagnant. Spire Aviation, which provides global flight tracking data powered by satellites, has monitored flight activity globally, which shows that Amazon Air has experienced almost 35% growth in terms of cargo flights around the world during 2021.

Compared to FedEx and UPS, the growth of Amazon Air has been remarkable. Data: Spire Aviation

It has also increased its airports served by almost 30% and has 25% more aircraft operated than it did at the start of the year. Conversely, FedEx and UPS did not notably grow their airports served, and while the fleet size of UPS stagnated, Fed Ex actually ended the year with fewer aircraft than it had at the start. This was mainly due to the ongoing retirement of many of its McDonnell Douglas MD-10s, of which eight left the fleet in 2021.

While FedEx and UPS did not keep up with Amazon Air’s rapid growth, it’s important to put things in perspective. FedEx operates 473 aircraft of its own, while UPS operates 289. As such, a couple of aircraft additions at Amazon makes a much greater percentage difference.

.jpeg)

Although its growth is notable, Amazon Air’s fleet still remains a fraction of those of its competitors. Data: Spire Aviation

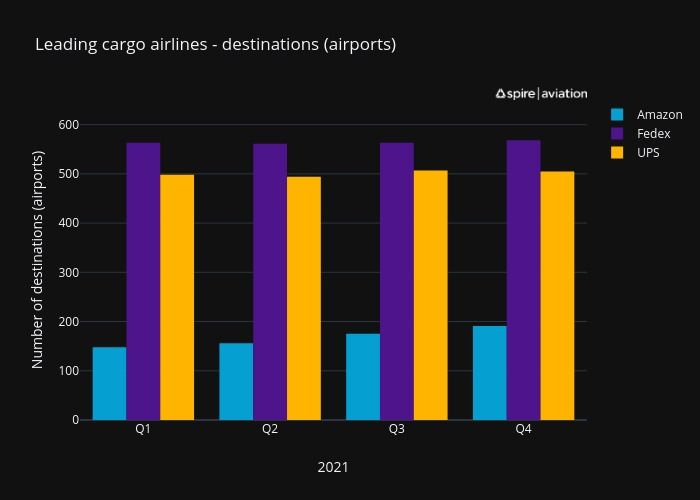

Perhaps the most notable measure of Amazon Air’s rapid expansion is the number of airports it serves. While FedEx and UPS have largely kept their networks static throughout 2021, Amazon Air has been adding new connections month on month.

Spire Aviation data recorded the air cargo flights in fine detail, helping us to understand the various cargo operations worldwide. As the data shows, Amazon Air started the year with under 150 airports served. It finished up with close to 200 in place.

The number of destinations served by Amazon Air has grown steadily over the course of the year. Data: Spire Aviation

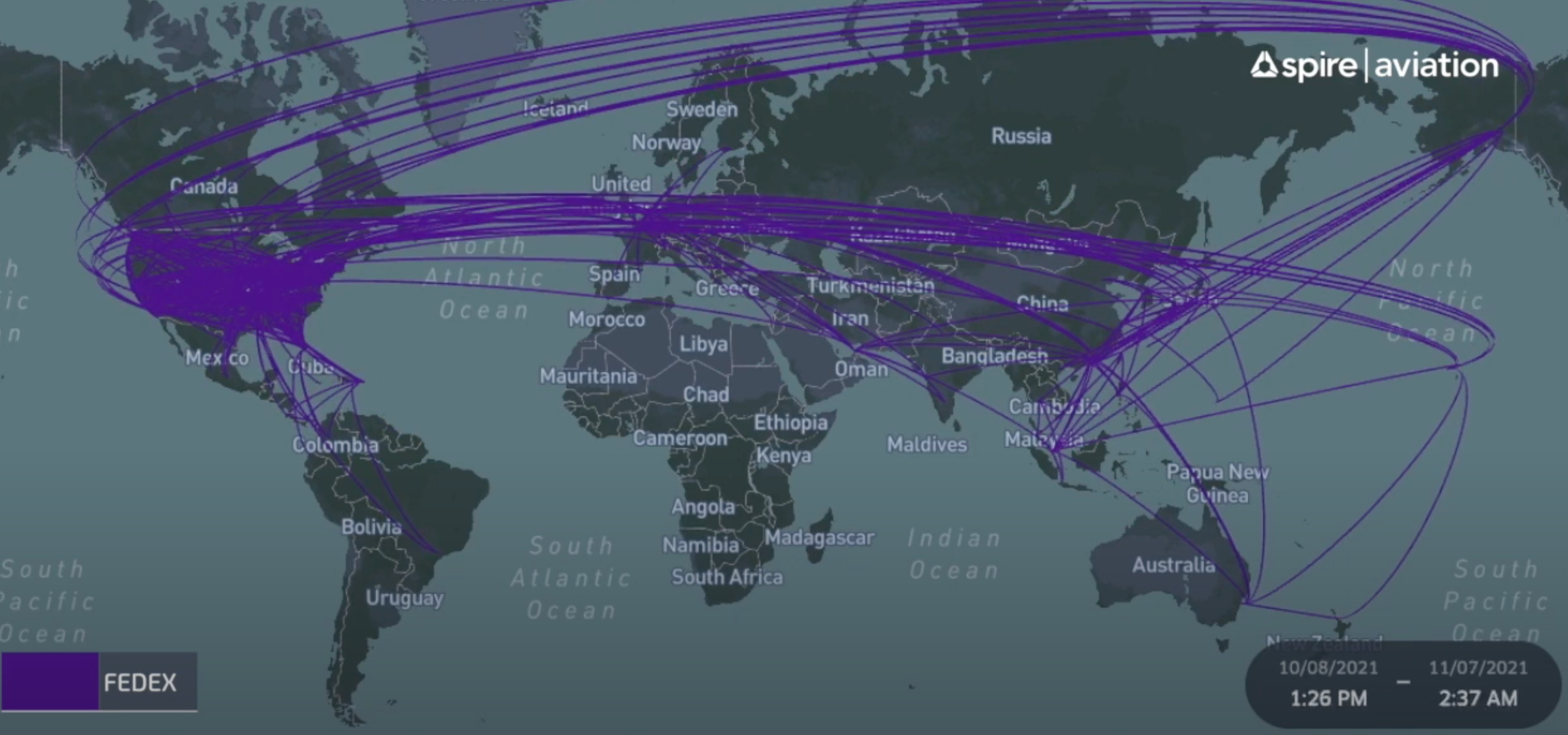

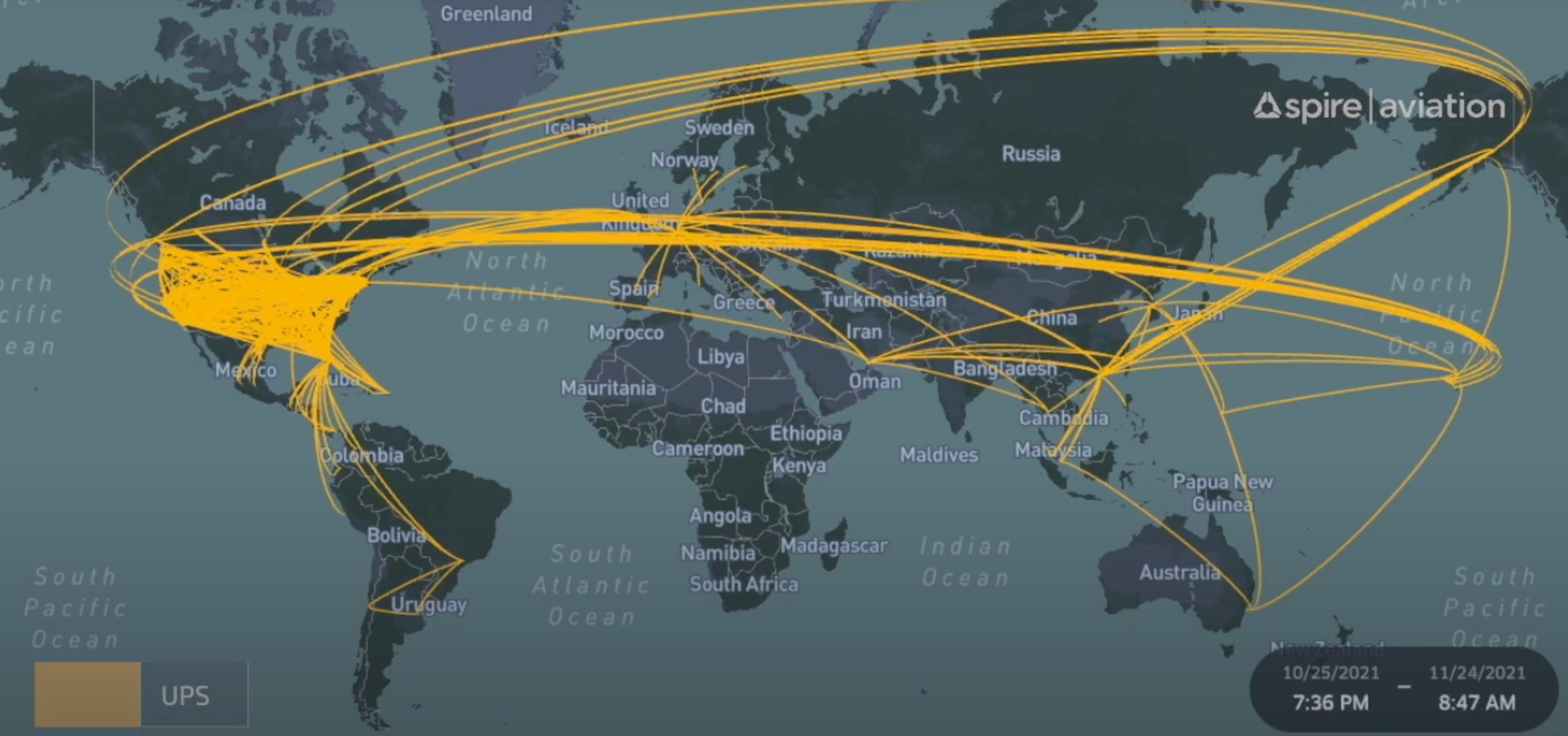

The way the airlines’ routes are organized also paints an interesting picture. According to the tracking data, both FedEx and UPS have solid domestic networks in the USA, and some distribution in Europe, but the majority of their time elsewhere is spent flying hub to hub, taking in Asia, South America and Australia.

FedEx routes span the world. Data: Spire Aviation

UPS is less spread out, but still connects in Asia-Pacific and the Middle East. Data: Spire Aviation

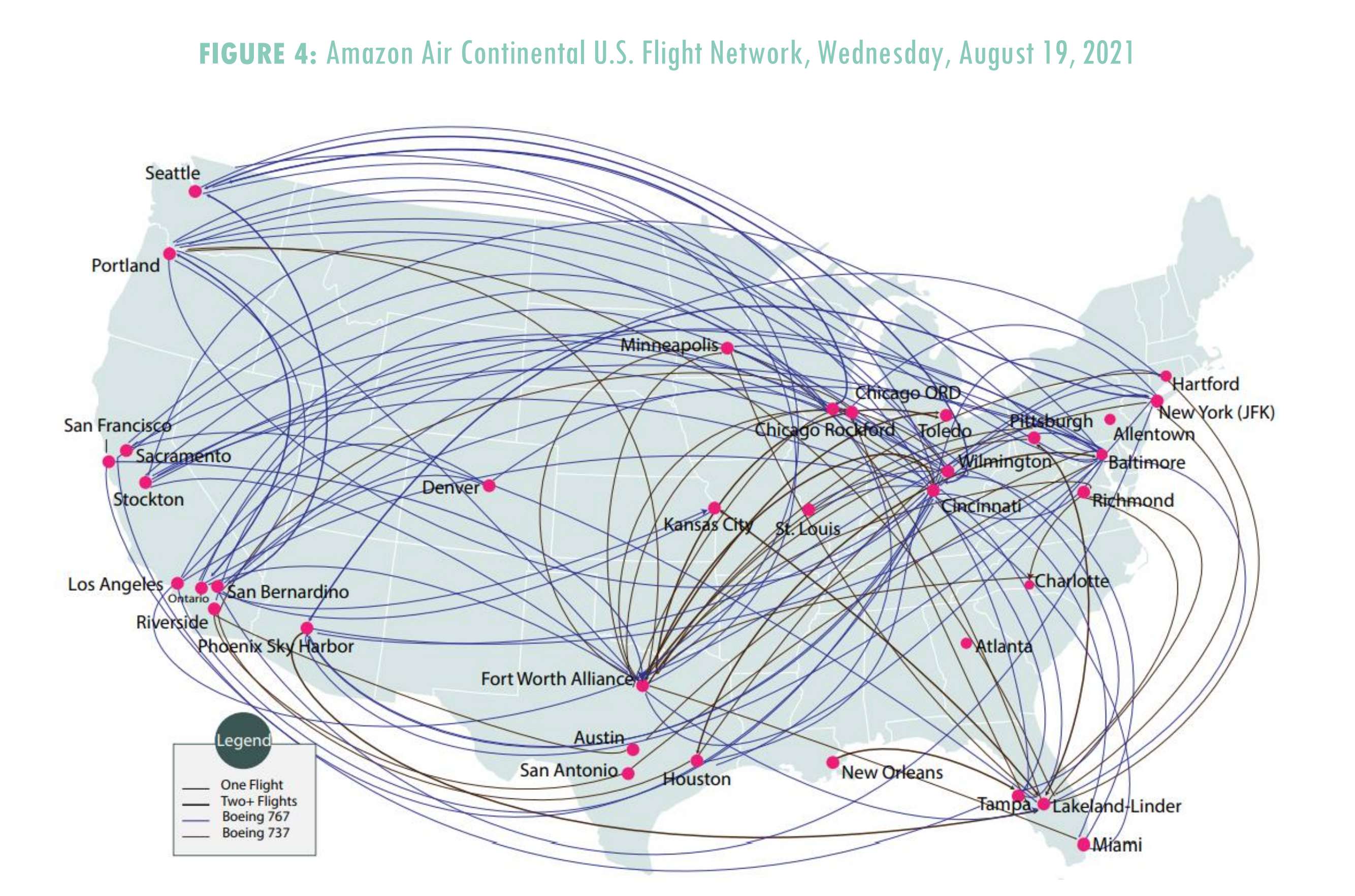

For Amazon Air, its activity has been 100% concentrated on its core markets of the USA and Europe. From its humble beginnings, Amazon now flies to 48 cities in the US, with hubs at San Bernardino, Cincinnati and Forth Worth. All that growth? That’s mainly from the US operations.

The majority of the airline’s growth has come from its US operations. Photo: Chaddick Institute for Metropolitan Development

It was only late 2020 when the retail giant opened its first European Amazon Air Hub, using the Leipzig/Halle Airport in Germany. It now touches 10 airports in Europe, including four in Italy and two in the UK. It is yet to travel any further afield, so still relies on the big boys to bring goods in from China.

Leipzig/Halle opened recently as Amazon’s first European base in late 2020. Photo: Amazon

However, the airline has flown to China, more than once. Some were demo flights and others charters. The 767 can make the trip, but the 777 could do it far more easily, and with a lot more space for the goods.

A crucial move in Amazon’s expansion took place in the third quarter of last year, when CNBC revealed that Amazon Air is now moving goods for third parties. This puts it in head-to-head competition with UPS and FedEx for business, and marks a turning point in the airline’s history. It’s no longer an airline for Amazon, it’s Amazon’s airline.

Amazon is moving into the third party air cargo market, lining it up for direct competition with the cargo behemoths of UPS and FedEx. Photo: Amazon

How much bigger can it get?

Amazon Air’s impact on the localities it serves cannot be understated. In 2019, it broke ground on its first hub at Cincinnati/Northern Kentucky International Airport. After two years of building works, the 800,000 square foot hub officially began operations.

The airline invested some $1.5 billion into the project and recruited some 2,000 people to bring it to life. The ‘nerve center’ of its US operations sits on a campus of more than 600 acres and includes a robotic sorting center where packages are sorted by zip code and loaded onto trucks. But it’s not full yet – it has the capacity for at least 100 Amazon planes and operations of 200 flights per day.

Amazon Air is not done yet. It is eyeing at least 85 planes by the end of 2022, a combination of leased and owned, and it could be looking to induct a new fleet type too. According to reporting in Bloomberg, it is keenly eyeing the Boeing 777-300ER as its next airplane.

The 777 has more capacity for cargo and, importantly, would allow Amazon to directly import goods from China. This would put even more in competition with FedEx and UPS, opening up more destinations and opportunities. While FedEx and Amazon’s route maps look very different today, in a few years’ time they could be much more similar.

The 777 might have caught the eye of Amazon Air. Photo: FedEx

But Amazon is not likely to be queuing up for the newly confirmed Boeing 777X freighter. The carrier’s business model is all about acquiring good quality used jets and passenger conversions for its operations. It is keenly focused on keeping its operational costs down, although it should be noted that, as a business, Amazon is prepared to take massive losses on the shipping of its own products in order to keep customers happy.

Whether it really does rise up to challenge the giants of UPS and FedEx remains to be seen.

What do you think? Let us know in the comments.

Read Next

About The Author