We’re witnessing the rise of a new type of company: the fully automated enterprise™. Fully automated enterprises have the potential to revolutionize how business is done and, in their wake, leave entire industries transformed.

Our customers are excited about the potential of full enterprise automation but curious about the path. We listened. Above all, our customers wanted an example, a model of a fully automated enterprise they could take back to their company and say, “This! This is what I want!”

In my previous article, I explained what a fully automated enterprise was and why your company should become one. I also described the four pillars your company could use to transform into a fully automated enterprise.

Now, I’ll walk you through what a fully automated enterprise really looks like using a fictitious company based on a real use case.

This fictitious company, which we’re calling Mortgage Originations Bank, is a United States (U.S. )-based Fortune 500 financial services company with a nationwide mortgage lending arm.

If you’ve ever applied for a mortgage in the U.S., you’ve glimpsed how messy and paper-intensive the process can be. This article will demonstrate what a company like this can do with fully realized automation.

Rewind: what are the four pillars of a fully automated enterprise?

Let’s recap: a fully automated enterprise is a company that automates wherever it makes the most sense. While traditional enterprises add automation without a clear plan, a fully automated enterprise thinks critically and expansively about how automation can transform the business.

As the previous article showed, a fully automated enterprise will outcompete other companies, reap significant ROI from its automation investments, and perform better than other enterprises. Becoming a fully automated enterprise will soon move from a goal to an imperative.

A fully automated enterprise drives its transformed business forward based on four pillars:

- Assigns all automatable work to robots and makes back-office work invisible

- Provides a robot for every person in the company and gives people superpowers, enabling them to focus on more valuable work

- Democratizes development so that power users can quickly build new automations and applications

- Applies artificial intelligence (AI) to every facet of work, expanding the footprint of automation into cognitive processes to automate more

Now, don’t get me wrong: pillars and frameworks are great by themselves, but examples are better.

Let’s dig into Mortgage Originations Bank and learn how they’ve become a fully automated enterprise and what enterprise automation has done for the business.

Pillar 1: Mortgage Originations Bank assigns all automatable work to robots

The first pillar of the fully automated enterprise is to automate whatever can be automated. A fully automated enterprise assigns any work that can be automated to a software robot, freeing humans to do other tasks. In particular, data-entry-intensive back-office work becomes almost entirely invisible.

Mortgage Originations Bank provides a good example of putting this enterprise automation principle into practice.

Mortgage officers at the bank juggled many loan applications at the same time, collecting and processing dozens of pieces of information and emailing with clients to gather what’s needed. They had to manually verify documents for completeness, type the information into multiple systems, and confirm it all lined up with the application. Unfortunately, mistakes were easy to make and wasted valuable time.

Loan-application approval is an emotional roller coaster for Mortgage Originations Bank’s customers; buying a house is one of the biggest financial decisions customers will make. Mistakes that may have been annoying in other contexts were stressful in this one. There’s no room for error or inefficiency.

So Mortgage Originations Bank did what any fully automated enterprise should do: it introduced automation where it could make the most impact. They knew robots could take care of repetitive, rules-based work and quickly reduce the amount of document processing their team had to do. Where needed, automation could loop in human counterparts to resolve issues. This empowered employees to manage long-running workflows across disparate systems.

As you can see in the demo, the UiPath Platform automatically extracted information from supporting loan documents, verified it, and consolidated it.

Behind the scenes, the robotic process automation (RPA) development team at Mortgage Originations Bank used UiPath Studio to build unattended robots to handle document collection.

These unattended robots use UiPath Document Understanding and UiPath AI Fabric to understand all the information contained in the relevant documents, such as W-2s and passports. Once the unattended robots parse this information, they push it to UiPath Action Center for human review. Here, the loan officer, engaging in a “human in the loop” process, can review any exceptions the unattended robots found. From there, approved data is pushed to Data Service, where it can be accessed by robots taking the next step in the loan process.

With all this freed time, the Mortgage Originations Bank mortgage loan officer can meet with clients, make loan decisions, and pursue new business. No longer is this officer spending precious time manually keying in data.

A fully automated enterprise makes the back office a thing of the past, freeing up humans to prioritize customer relationships in the future.

Pillar 2: Mortgage Originations Bank provides a robot for every person

The second pillar of the fully automated enterprise is to provide a robot for every person. Whereas the first pillar involved unattended robots making back-office work invisible, this pillar involves highly visible attended robots working alongside every employee in the company.

Side note: need a quick reminder on unattended and attended robots? Here you go:

In traditional businesses, would-be leaders may implement automation in the back offices and stop there. In a fully automated enterprise, robots are not only doing invisible back-office work but are also deeply integrated into people’s day-to-day activities.

At Mortgage Originations Bank, the RPA team saw two use cases that called for attended automation:

- 1. Wealth managers needed to identify and pursue high-net-worth individuals.

- 2. Contact centers needed to consolidate and use disparate pieces of customer information.

Without automation, prospecting involves manually scouring public record documents and tediously creating personalized outreach plans. Instead, Mortgage Originations Bank developed a robot that can process documents and prepare personalized email outreach the wealth manager can approve and send.

As you saw in the demo, UiPath Assistant sits on the wealth manager’s desktop and runs attended automations. These processes, governed by a center of excellence (CoE), are all compliant and preapproved.

In this use case, a wealth manager is preparing a weekly portfolio update for customers. The wealth manager runs their outreach process to do so. All the wealth manager has to do is select a date range. The robot runs the rest of the process picture in picture, so users can watch the automation run as they work on other tasks.

The robot automatically extracts contacts for outreach. If any contacts are missing, the robot can automatically communicate with the prospect-outreach team and request the missing contacts. Once done, the robot creates draft emails—integrating with programs like Salesforce and Marketo—that the wealth manager can review and send.

Contact centers provided another compelling reason to have all employees work with software robots, this time in the form of a UiPath app. Mortgage Originations Bank wasn’t content with the inefficiency involved as agents transferred information from system to system in order to help customers.

Mortgage Originations Bank used a software robot-powered app to consolidate information and provide agents with upsell and cross-sell opportunities, dramatically reducing the average call duration while dramatically increasing the chance of a sale.

As you can see in the demo, robots make a contact center agent’s life much easier. The agent gets all the caller information they need directly in their interface once the call is accepted. That includes the entire history of the contact and all the reasons they’ve previously called. Robots populate this interface with information from multiple sources, including the agent’s customer relationship management (CRM) tool and systems that store the contact’s transaction history and next best offer.

When the agent and customer connect, the agent can pull up every account and inquiry the customer has made and ask which one is of concern that day. Before, a question like this required that the agent move across four or five different systems, but now it happens in mere seconds. On the call, the agent can zoom in and out on the customer’s purchase history and easily reverse transactions.

With the problem solved, the agent can then upsell. Robots automatically retrieve the most relevant offers based on that customer’s demonstrated interest on the website.

As the demo shows, UiPath Assistant and UiPath Apps make automation consumable and useful throughout an organization. You can truly put automation into the hands of every user. That accessibility is key for companies seeking to take full advantage of enterprise automation.

Pillar 3: Mortgage Originations Bank democratizes development

The third pillar of the fully automated enterprise is to democratize development and make automation available to business users. Every company has what we call a “long tail” of automation opportunities. Each of these opportunities, in isolation, appears small, but in aggregate, these opportunities represent a massive amount of unrealized productivity gains.

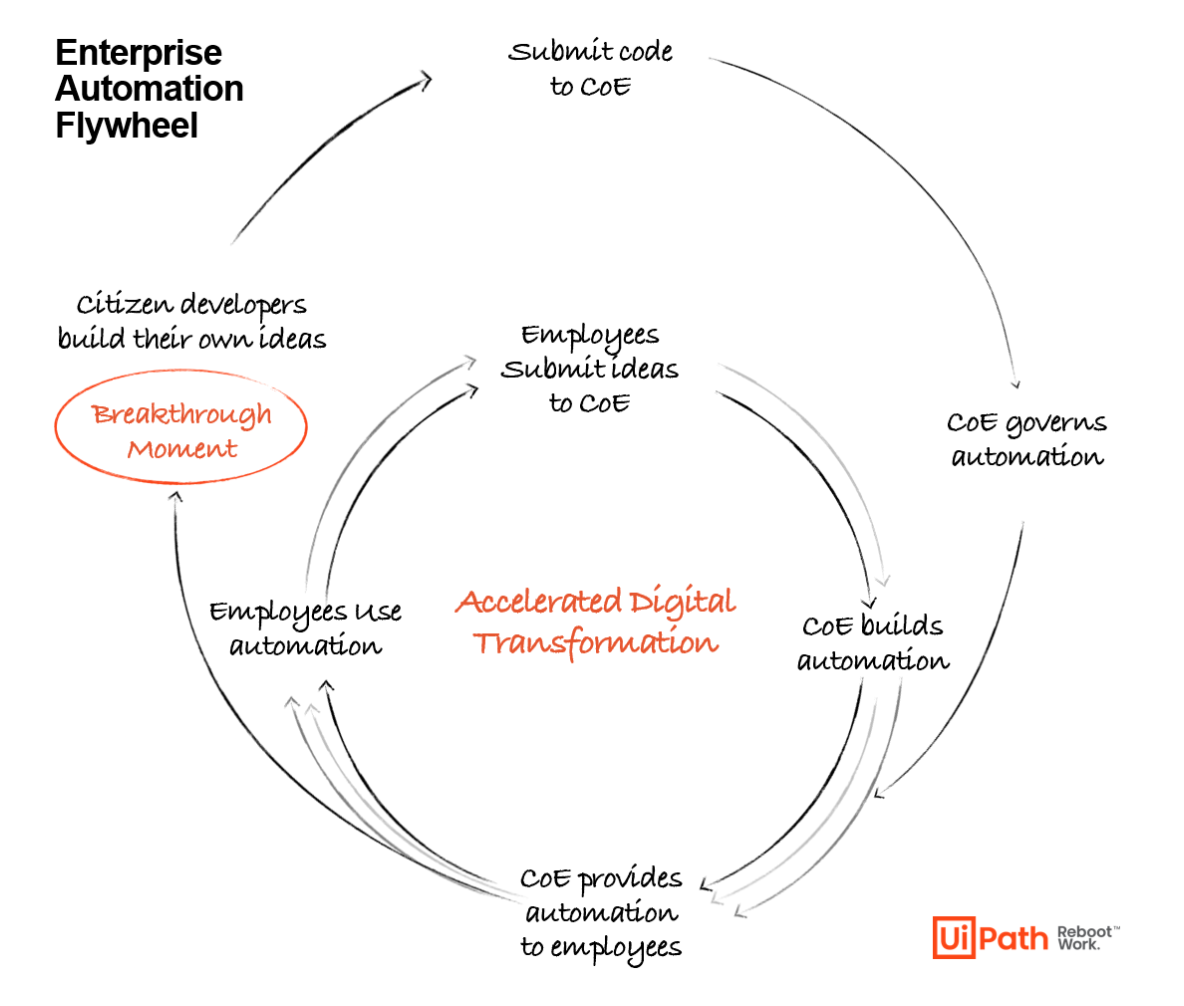

Development teams don’t have the resources to spare to dive into every seemingly small problem. A fully automated enterprise solves the long-tail problem by putting low-code automation tools into the hands of business users. As we talked about in The 4 Pillars of a Fully Automated Enterprise, this is how companies can kickstart the second layer of the automation flywheel.

The first layer involves a CoE building automations, and employees submitting automation ideas. The second layer, enabled by this pillar, is when citizen developers find their own use cases and build their own automations.

Let’s take a look at what it’s like when the flywheel is spinning at a fully automated enterprise.

The pandemic caused an influx of deferred-payment requests, which required inefficient manual data verification and compilation by Mortgage Origination Bank mortgage officers. To get the job done, officers had to combine a bunch of different tools—Microsoft Excel for calculations, a password generator for passwords, and a word processor for email templates—which further slowed how well they could help customers.

Problem was, their CoE couldn’t see how inefficient this process was because the work was too in the weeds and specific to each employee. But a mortgage specialist, empowered by their CoE, knew that the process could be improved with automation. So they turned to UiPath StudioX to build their own robot and submit it to the CoE for approval. One problem turned into many solutions.

As you can see from the demo, the mortgage specialist swapped between a variety of different tools. With StudioX, she can automate this entire process. She started from a template provided in StudioX that can already pull data and generate emails. All she needed to do is edit it to pull information from the right places and update the right details.

From there, she can do the rest of the process herself as a robot watches. After doing it once, the robot can automatically replicate the steps across data-pulling, password-generating, and email-writing. The mortgage specialist can then publish this automation to UiPath Automation Hub for the CoE to evaluate. If it can work for others, the CoE distributes it for everyone to use.

Now, let’s take the case of contact centers again, where agents have to consolidate a lot of information at once. In this example, a new regulation passed that affected customers, and the contact center struggled to deal with a surge of related inquiries. Agents had to sort through numerous applications to find the right information.

A contact center team builds a software robot-powered app that consolidates the information their team needs. Everything they refer to is accessible as they talk to customers. The solution is browser based and works across platforms.

As you can see in the demo, the contact center team used UiPath Apps to build an application for mortgage deferrals. The contact center built an app themselves with labels, tables, and a button for generating emails. They were able to style components with colors and formatting. From there, they added software robot-powered processes to fill out the workflow. They were even able to add details like a loading spinner, which shows users when the app is busy calculating.

With UiPath StudioX and Apps, business users can take a point and click approach to enterprise automations. A fully automated enterprise, once it arms its business users with robots, can solve the long tail of automation.

Pillar 4: Mortgage Originations Bank applies AI to every facet of work

The fourth pillar of the fully automated enterprise is to apply AI to every facet of work. In a fully automated enterprise, AI suffuses all processes, finding new processes to automate, creating more complex automations and enabling robots to make more cognitive decisions. In a fully automated enterprise, AI is everywhere.

While other companies start and stick to low-hanging fruit, a fully automated enterprise leverages the power robots provide to create an environment for AI success. A fully automated enterprise can layer AI over the use cases we’ve talked about previously and discover opportunities faster and offer even better solutions.

For our first example, let’s look back at the loan officers from the first pillar. These loan officers are struggling with tedious paperwork that consumes the loan application process. In a fully automated enterprise, process mining identifies the loan application process as one ripe for automation.

Every day, the loan officers determine which contacts to follow up on. Before automation, loan officers manually filled in the information of contacts, a process that required gathering data across numerous systems and apps. The goal was to gather enough information, such as debt-to-income ratio, credit score, and length of employment, to score how likely each contact was to default. The more likely to default, the more urgent the loan officer had to be about reaching out. This was tedious, slow, and—you guessed it—totally automatable.

For many enterprises, this use case, which calls on some cognitive decision-making, wouldn’t be on their automation radar. A fully automated enterprise like Mortgage Originations Bank, however, can use a machine learning model to help robots make decisions. In this case, robots input all the customer data into a CRM. But with AI, they can also analyze contacts and assign them a score that indicates how likely they are to default. The next day, the loan officer can prioritize which customers to reach out to based on that score.

As you can see in the demo, automation can make surprisingly quick work of a cognitively intense task.

A data scientist creates a trained AI model for predicting likeliness to default based on past data. Machine learning skills then expose this prediction for use in the UiPath Platform. Business users can then call the machine learning model and receive answers. As an added bonus, the person building this workflow uses Object Repository, which is a database of user interface (UI) elements that your app is working with. It’s a database that you can version and reuse across workflow files and automations.

The automation can open a browser, log into the loan officer’s CRM, type in the relevant data, and pull in the prediction-to-default score from the machine learning model.

The use cases for AI don’t end there.

In a fully automated enterprise, development teams also use AI to actually build applications. UiPath AI Computer Vision, for instance, enables automation tools to work with any application surface.

Beyond computer vision, we also now make it possible to run any machine learning skills natively within UiPath—even for on-premises deployments. You can also use AI Fabric to automate processes that have historically needed human cognitive skills.

AI makes enterprise automation easier to deploy and more effective once implemented.

Embracing the future of enterprise automation

Let the fictitious Mortgage Originations Bank serve as your model. With the right mindset, the right commitment, and the right technology, you, too, can become a fully automated enterprise—and reap all the benefits that transformation entails.

Fully automated enterprises aren’t theory, nor are they science fiction: they’re possible, and they’re here. We developed these four pillars to give you guidance on developing your automation program. Your vision can be as ambitious as it is practical.

Missed Bobby Patrick and Param Kahlon’s presentations at the Reboot Work Festival? Sign up to see them.

Today is the final day of the Reboot Work Festival, so there’s still a lot to see and be a part of!