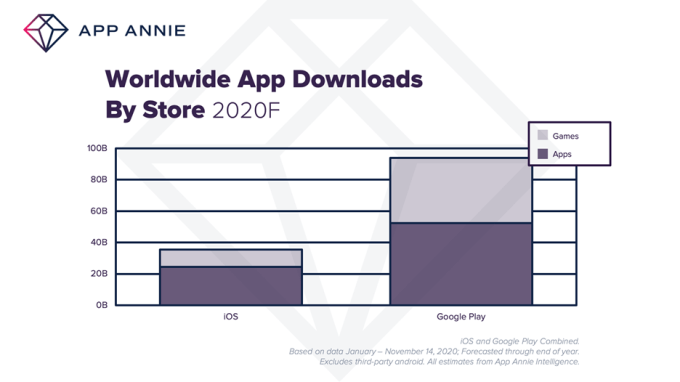

Consumers will have downloaded 130 billion apps in 2020 across iOS and Google Play, up 10% year-over-year, according to app store analytics firm App Annie’s year-end forecast. Consumer spending across the two app stores will also grow by 25% year-over-year to reach $112 billion by year end, the firm also predicts.

Typically, much of the download growth is led by emerging markets, but this year things were different.

Due the COVID-19 pandemic, mobile adoption accelerated by 2 to 3 years. As a result, consumers increasingly turned to apps as digital solutions for work, education, entertainment, shopping, and more. This resulted in the rise in downloads, time spent on mobile, and consumer spending — despite there being more maturity in the mobile market.

Image Credits: App Annie

Google Play downloads in 2020 outnumbered iOS downloads by 160%, but both stores saw 10% growth. Games, meanwhile, increased their share of the downloads to 40%. On Google Play, they accounted for 45% of all downloads, up 5% year-over-year, but they maintained a 30% share on iOS. Games additionally accounted for $0.71 of every dollar spent across both app stores.

Also due to COVID-19, consumers spent more time on devices — a metric that saw a significant 25% jump from 2019 to top 3.3 trillion hours on Android. (App Annie cannot measure the figure on iOS).

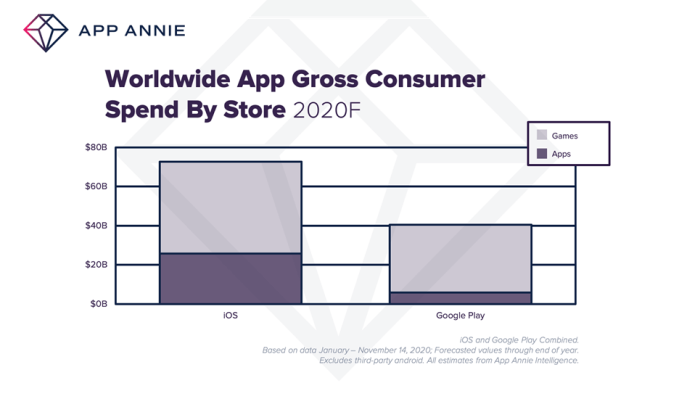

Image Credits: App Annie

This increased time spent helped contribute to the growth in consumer spending, which hit a new annual record ($112B) in 2020. In 2020, 65 cents of every dollar of that spend went to iOS but spend on Google Play continues to grow. This year, it will reach close to 30%, the firm predicts.

Top markets for consumer spend on iOS included the U.S., Japan, and the U.K., which is a different list than in 2018 and 2019, when the list included U.S., China, and Japan. Top markets for Google Play were the U.S., South Korea and Germany — with South Korea and Germany bumping out Japan and the U.K.’s place in terms of growth, compared with the past 2 years.

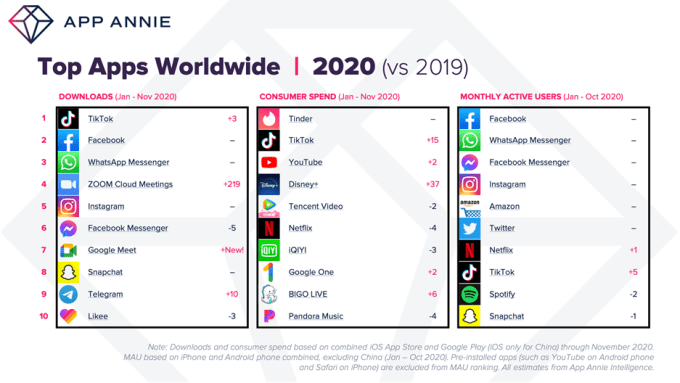

The report also looked at the top apps of the year, which saw TikTok No.1 by downloads and No. 2 by consumer spend, but still beat out by Facebook on monthly active users. Despite a lockdown, dating app Tinder made it to No. 2 in terms of consumer spend.

Other Facebook apps, including Instagram, Messenger, and WhatsApp maintained top positions across download and active users charts.

Image Credits: App Annie

We should note today’s numbers don’t paint a full picture of the mobile market, as they exclude third-party app stores in China. Those figures are wrapped into App Annie’s more extensive “State of Mobile” report that tends to arrive early in the year for the year prior.

[ad_2]

Source link